a)

The question requires us to draw a graph representing the loanable fund market and correctly label the variables.

a)

Explanation of Solution

The loanable fund market represents the market

An increase in savings in a market indicates a higher supply of loanable funds. Similarly, an increase in demand for loans indicates a higher demand in the loanable fund market.

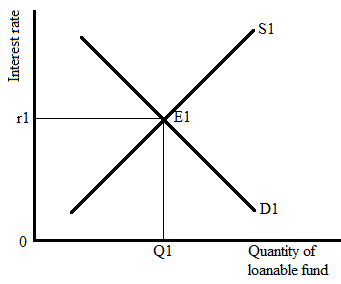

The following graph represents the market for loanable funds:

Here, curve S1 represents the supply curve, and curve D1 represents the demand curve in the loanable fund market. The intersection of the supply and demand curve will give the equilibrium at point E1.

The equilibrium rate of interest is r1.

Q1 is the equilibrium quantity of loanable funds.

b)

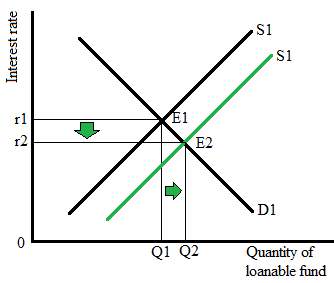

The question requires us to show the impact of increased government spending on the loanable fund market using the graph.

b)

Explanation of Solution

An increase in government spending will increase the level of savings in the economy because people will have more disposable income in their hands to spend or save. When people save more, the supply of loanable funds in the market will increase and as the result, the supply curve will shift to the right from S1 to S2 as shown in the figure.

A higher supply of loanable funds causes the equilibrium to reach point E2 where the new interest rate is r2 which is below the initial rate, and Q2 is the new equilibrium quantity of loanable funds.

c)

The question requires us to determine the impact of the new interest rate on the real

c)

Explanation of Solution

There is an inverse relationship between the interest rate and the rate of investment.

A higher interest rate reflects higher borrowing costs that disincentivize investors to take loans and make investments in the market or their businesses. Thus, investment in the market will fall.

Similarly, a lower interest rate indicates lower borrowing costs that incentivize the investors to borrow from the loanable fund market, and the investments in the market will increase.

So, a fall in the interest rate from r1 to r2 will increase the investment in the market.

A higher investment causes the real GDP to rise because an increase in investment represents a higher production capacity in the firms that, in turn, causes the production of goods and services to increase and results in a higher real GDP level.

Chapter 5R Solutions

Krugman's Economics For The Ap® Course

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education