PRIN.OF CORPORATE FINANCE

13th Edition

ISBN: 9781260013900

Author: BREALEY

Publisher: RENT MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 7, Problem 18PS

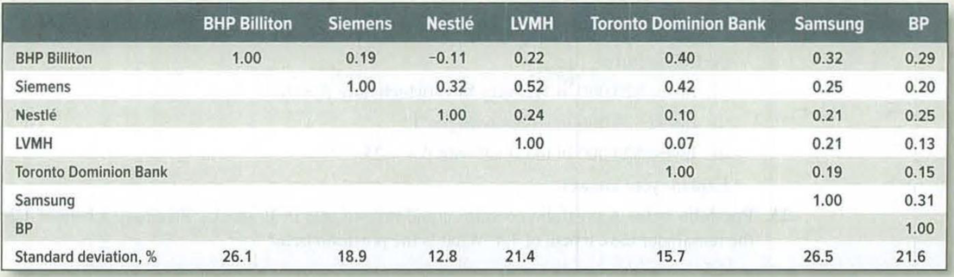

Portfolio risk Table 7.8 shows standard deviations and correlation coefficients for seven

stocks from different countries. Calculate the variance of a portfolio with equal investments

in each stock.

TABLE 7.8 Standard deviations of returns and correlation coefficients for a sample of seven stocks

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Question 1

Refer to the following observations for stock A and the market portfolio in the table:Month Stock A Market portfolio1 0.30 0.122 0.24 0.083 -0.04 -0.104 0.10 -0.025 0.06 0.086 0.10 0.07

a) Calculate the main statistic measures to explain the relationship between stock A and the market portfolio:• The sample covariance between rate of return for the stock A and the market;• The sample Beta factor of stock A;• The sample correlation coefficient between the rates of return of the stock A and the market

Calculate the correlation coefficient for the portfolio using the following information:

Variance of Stock X 0.08 Variance of Stock Y 0.06

Covariance is 0.05

a. 0.1042

b. 0.7217

c. 0.00024

d. 0.0693

Kindly answer 11 and 12

Using the stock price data for any two companies provided below carry out the following tasks:

1.Compute, for each asset:

i.Total Returns

ii.Expected returns

iii.standard deviation

iv.Correlation Coefficient

2.Construct the variance-covariance matrix

3.Construct equally weighted portfolio and calculate Expected Return, Standard Deviation and Sharpe ratio.

4.Reconstruct equally weighted portfolio and calculate Expected Return, Standard Deviation and Sharpe ratio.

5.Use Solver to determine optimal risky portfolio.

6.Create hypothetical portfolios (commencing from Weight A=0 and weight B=100)

7.Calculate Expected return and Standard Deviation for all the above combinations

8.Graph the efficient frontier

9.Graph the optimal portfolio

10.Assuming that the investors prefers lower level of risk than what a portfolio of risky assets offer, introduce a risk free asset in the portfolio with a return of 3%

11.Using hypothetical weights (A= Portfolio of Risky Assets, B= 1…

Chapter 7 Solutions

PRIN.OF CORPORATE FINANCE

Ch. 7 - Rate of return The level of the Syldavia market...Ch. 7 - Real versus nominal returns The Costaguana stock...Ch. 7 - Arithmetic average and compound returns Integrated...Ch. 7 - Risk premiums Here are inflation rates and U.S....Ch. 7 - Risk Premium Suppose that in year 2030, investors...Ch. 7 - Stocks vs. bonds Each of the following statements...Ch. 7 - Expected return and standard deviation A game of...Ch. 7 - Standard deviation of returns The following table...Ch. 7 - Average returns and standard deviation During the...Ch. 7 - Prob. 10PS

Ch. 7 - Prob. 11PSCh. 7 - Diversification Here are the percentage returns on...Ch. 7 - Risk and diversification In which of the following...Ch. 7 - Prob. 14PSCh. 7 - Portfolio risk To calculate the variance of a...Ch. 7 - Portfolio risk a) How many variance terms and how...Ch. 7 - Portfolio risk Table 7.8 shows standard deviations...Ch. 7 - Portfolio risk Hyacinth Macaw invests 60% of her...Ch. 7 - Stock betas What is the beta of each of the stocks...Ch. 7 - Stock betas There are few, if any, real companies...Ch. 7 - Portfolio betas A portfolio contains equal...Ch. 7 - Portfolio betas Suppose the standard deviation of...Ch. 7 - Portfolio risk Here are some historical data on...Ch. 7 - Portfolio risk Suppose that Treasury bills offer a...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- PLEASE EXPLAIN HOW ANSWERS WERE FOUND Using the data in the following table,calculate the volatility (standard deviation) of a portfolio that 54% is invested in stock A and 46% in stock B.arrow_forwardExpected return of a portfolio using beta. The beta of four stocks—P, Q, R, and S—are 0.49, 0.81, 1.19, and 1.53, respectively and the beta of portfolio 1 is 1.01, the beta of portfolio 2 is 0.86, and the beta of portfolio 3 is 1.15. What are the expected returns of each of the four individual assets and the three portfolios if the current SML is plotted with an intercept of 4.5% (risk-free rate) and a market premium of 12.0% (slope of the line)? What is the expected return of stock P? (Round to two decimal places.) What is the expected return of stock Q? (Round to two decimal places.) What is the expected return of stock R? (Round to two decimal places.) What is the expected return of stock S? (Round to two decimal places.) What is the expected return of portfolio 1? (Round to two decimal places.) What is the expected return of portfolio 2? (Round to two decimal places.) What is the expected return of portfolio 3?…arrow_forwardFrom the following information, calculate covariance between stocks A and B and expected return and risk of a portfolio in which A and B are equally weighted.Which stock would be recommend if investment in individual stock is to be made? Justify answer using numerical calculations. Stock A Stock B Expected return 24% 35% Standard deviation 12% 18% Coefficient of correlation 0.65 0.65arrow_forward

- 1.2. Refer to the following observations for stock A and the market portfolio in the table: Month Rate of return Stock A Market portfolio 1 0.30 0,12 0.24 0,08 3 -0,04 -0,10 -0,02 0,08 0,07 4 0,10 5 0,06 6 0,10 a) Calculate the main statistic measures to explain the relationship between stock A and the market portfolio: i) The sample covariance between rate of return for the stock A and the market. ii) The sample Beta factor of stock A. iii) The sample correlation coefficient between the rates of return of the stock A and the market. iv) The sample coefficient of determination associated with the stock A and the mar- ket. b) Draw in the characteristic line of the stock A and give the interpretation - what does it show for the investor? c) Calculate the sample residual variance associated with stock's A characteristic line and explain how the investor would interpret the number of this statistic. d) Do you recommend this stock for the investor with the lower tolerance of risk?arrow_forwardFrom the following information, calculate covariance between stocks A and B and expected return and risk of a portfolio in which A and B are equally weighted.Which stock would be best recommend if investment in individual stock is to be made? Justify the answer using numerical calculations. Stock A Stock B Expected return 24% 35% Standard deviation 12% 18% Coefficient of correlation 0.65arrow_forwardExpected return of a portfolio using beta. The beta of four stocks—G, H, I, and J—are 0.44, 0.75, 1.21, and 1.55, respectively and the beta of portfolio 1 is 0.99, the beta of portfolio 2 is 0.83, and the beta of portfolio 3 is 1.14. What are the expected returns of each of the four individual assets and the three portfolios if the current SML is plotted with an intercept of 3.5% (risk-free rate) and a market premium of 10.0% (slope of the line) What is the expected return of portfolio 1? (Round to two decimal places.) What is the expected return of portfolio 2? (Round to two decimal places.) What is the expected return of portfolio 3? (Round to two decimal places.)arrow_forward

- Expected return of a portfolio using beta. The beta of four stocks—G, H, I, and J—are 0.44, 0.75, 1.21, and 1.55, respectively and the beta of portfolio 1 is 0.99, the beta of portfolio 2 is 0.83, and the beta of portfolio 3 is 1.14. What are the expected returns of each of the four individual assets and the three portfolios if the current SML is plotted with an intercept of 3.5% (risk-free rate) and a market premium of 10.0% (slope of the line)? What is the expected return of stock G? (Round to two decimal places.) What is the expected return of stock H? (Round to two decimal places.) What is the expected return of stock I? (Round to two decimal places.) What is the expected return of stock J? (Round to two decimal places.) What is the expected return of portfolio 1? (Round to two decimal places.) What is the expected return of portfolio 2? (Round to two decimal places.) What is the expected return of portfolio 3?…arrow_forwardFrom the information attached below, calculate: a. the average stock return from 20x1- 20x3. b. The standard deviation over the same period.arrow_forwardConsider two stocks, Stock D with an expected return of 21 percent and a standard deviation of 36 percent and Stock I, an international company, with an expected return of 9 percent and a standard deviation of 24 percent. The correlation between the two stocks is -22. What are the expected return and standard deviation of the minimum variance portfolio? (Round your answer to 2 decimal places. Omit the "%" sign in your response.) Expected return Standard deviation % %arrow_forward

- Calculate the expected return, variance, and standard deviation for a portfolio of four equally weighted stocks with returns of 26.4%, -9.2%, 2.9%, and 22.0%arrow_forwardThe table summarizes the annual mean returns, variances and standard deviations using the monthly return data for four major stock market indexes. Which market is considered most risky using CV (coefficient of variation) as a measure of risk? Market A B C D Market A Market B Market C Market D Mean Return (%) 5 9.4 12 9.3 Variance of Return 184.96 501.76 462.25 368.64 STDEV (%) 13.6 22.4 21.5 19.2arrow_forwardThe correlation coefficient between stock B and the market portfolio is 0.8. The standard deviation of stock B is 24 percent and the standard deviation of the market is 30 percent. Calculate the beta of the stock. 0.64 0.92 0.80 1.00 1.42arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Portfolio return, variance, standard deviation; Author: MyFinanceTeacher;https://www.youtube.com/watch?v=RWT0kx36vZE;License: Standard YouTube License, CC-BY