Fundamentals Of Financial Accounting

6th Edition

ISBN: 9781259864230

Author: PHILLIPS, Fred, Libby, Robert, Patricia A.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 8, Problem 14E

Using Financial Statement Disclosures to Infer

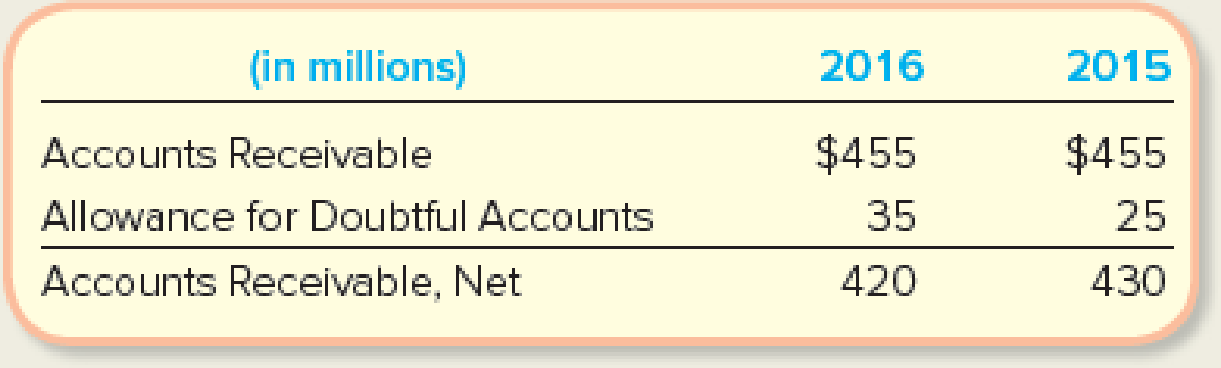

The annual report for Sears Holdings Corporation contained the following information:

Assume that accounts receivable write-offs amounted to $1 during 2016 and $9 during 2015 and that Sears did not record any recoveries.

Required:

Determine the Bad Debt Expense for 2016 based on the above facts.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

The data below is for Alta Corporation for 2016.Accounts receivable--December 31, 2016 $2,144,000Customer accounts written off as uncollectible during 2016 32,000Allowance for doubtful accounts--January 1, 2016 34,800Estimated uncollectible accounts based on an aging analysis 42,400

If the aging approach is used to estimate bad debts, determine the bad debt expense for 2016.

Castle Company provides estimates for its uncollectible accounts. The allowance for uncollectible accounts had acredit balance of $17,280 at the beginning of 2018 and a $22,410 credit balance at the end of 2018 (after adjusting entries). If the direct write-off method had been used to account for uncollectible accounts (bad debt expenseequals actual write-offs), the income statement for 2018 would have included bad debt expense of $17,100 andrevenue of $2,200 from the collection of previously written off bad debts.Required:Determine bad debt expense for 2018 according to the allowance method.

Average Uncollectible Account Losses and Bad Debt Expense

The accountant for Porile Company prepared the following data for sales and losses from uncollectible accounts:

Losses from

Year

Credit Sales

Uncollectible Accounts*

2015

$866,000

$11,125

2016

952,000

14,840

2017

1,083,000

16,790

2018

1,189,000

16,850

*Losses from uncollectible accounts are the actual losses related to sales of that year (rather than write-offs of that year).

Required:

1. Calculate the average percentage of losses from uncollectible accounts for 2015 through 2018. Enter your answer as percentage, rounded to one decimal place (e.g. .0248563 to 2.5%).

1.45 x %

2. Assume that the credit sales for 2019 are $1,300,000 and that the weighted average percentage calculated in Requirement 1 is used as an estimate of losses from uncollectible accounts for 2019 credit sales.

Determine the bad debt expense for 2019 using the percentage of credit sales method. Round your answer to the nearest dollar.

5,931 X

Chapter 8 Solutions

Fundamentals Of Financial Accounting

Ch. 8 - What are the advantages and disadvantages of...Ch. 8 - Prob. 2QCh. 8 - Which basic accounting principles does the...Ch. 8 - Using the allowance method, is Bad Debt Expense...Ch. 8 - What is the effect of the write-off of...Ch. 8 - How does the use of calculated estimates differ...Ch. 8 - A local phone company had a customer who rang up...Ch. 8 - What is the primary difference between accounts...Ch. 8 - What are the three components of the interest...Ch. 8 - As of May 1, 2016, Krispy Kreme Doughnuts had...

Ch. 8 - Does an increase in the receivables turnover ratio...Ch. 8 - What two approaches can managers take to speed up...Ch. 8 - When customers experience economic difficulties,...Ch. 8 - (Supplement 8A) Describe how (and when) the direct...Ch. 8 - (Supplement 8A) Refer to question 7. What amounts...Ch. 8 - 1. When a company using the allowance method...Ch. 8 - 2. When using the allowance method, as Bad Debt...Ch. 8 - 3. For many years, Carefree Company has estimated...Ch. 8 - 4. Which of the following best describes the...Ch. 8 - 5. If the Allowance for Doubtful Accounts opened...Ch. 8 - 6. When an account receivable is recovered a....Ch. 8 - Prob. 7MCCh. 8 - 8. If the receivables turnover ratio decreased...Ch. 8 - Prob. 9MCCh. 8 - Prob. 10MCCh. 8 - Prob. 1MECh. 8 - Evaluating the Decision to Extend Credit Last...Ch. 8 - Reporting Accounts Receivable and Recording...Ch. 8 - Recording Recoveries Using the Allowance Method...Ch. 8 - Recording Write-Offs and Bad Debt Expense Using...Ch. 8 - Determining Financial Statement Effects of...Ch. 8 - Estimating Bad Debts Using the Percentage of...Ch. 8 - Estimating Bad Debts Using the Aging Method Assume...Ch. 8 - Recording Bad Debt Estimates Using the Two...Ch. 8 - Prob. 10MECh. 8 - Prob. 11MECh. 8 - Recording Note Receivable Transactions RecRoom...Ch. 8 - Prob. 13MECh. 8 - Determining the Effects of Credit Policy Changes...Ch. 8 - Prob. 15MECh. 8 - (Supplement 8A) Recording Write-Offs and Reporting...Ch. 8 - Recording Bad Debt Expense Estimates and...Ch. 8 - Determining Financial Statement Effects of Bad...Ch. 8 - Prob. 3ECh. 8 - Recording Write-Offs and Recoveries Prior to...Ch. 8 - Prob. 5ECh. 8 - Computing Bad Debt Expense Using Aging of Accounts...Ch. 8 - Computing Bad Debt Expense Using Aging of Accounts...Ch. 8 - Recording and Reporting Allowance for Doubtful...Ch. 8 - Recording and Determining the Effects of Write-Off...Ch. 8 - Recording Note Receivable Transactions, Including...Ch. 8 - Recording Note Receivable Transactions, Including...Ch. 8 - Recording Note Receivable Transactions, Including...Ch. 8 - Using Financial Statement Disclosures to Infer...Ch. 8 - Using Financial Statement Disclosures to Infer Bad...Ch. 8 - Prob. 15ECh. 8 - Analyzing and Interpreting Receivables Turnover...Ch. 8 - (Supplement 8A) Recording Write-Offs and Reporting...Ch. 8 - Recording Accounts Receivable Transactions Using...Ch. 8 - Interpreting Disclosure of Allowance for Doubtful...Ch. 8 - Recording Notes Receivable Transactions Jung ...Ch. 8 - Accounting for Accounts and Notes Receivable...Ch. 8 - Analyzing Allowance for Doubtful Accounts,...Ch. 8 - Recording Accounts Receivable Transactions Using...Ch. 8 - Interpreting Disclosure of Allowance for Doubtful...Ch. 8 - Recording Notes Receivable Transactions CS...Ch. 8 - Accounting for Accounts and Notes Receivable...Ch. 8 - Analyzing Allowance for Doubtful Accounts,...Ch. 8 - Recording Accounts Receivable Transactions Using...Ch. 8 - Prob. 2PBCh. 8 - Prob. 3PBCh. 8 - Accounting for Accounts and Notes Receivable...Ch. 8 - Analyzing Allowance for Doubtful Accounts,...Ch. 8 - Recording and Reporting Credit Sales and Bad Debts...Ch. 8 - Prob. 2COPCh. 8 - Recording Daily and Adjusting Entries Using FIFO...Ch. 8 - Prob. 1SDCCh. 8 - Prob. 2SDCCh. 8 - Ethical Decision Making: A Real-Life Example You...Ch. 8 - Critical Thinking: Analyzing the Impact of Credit...Ch. 8 - Using an Aging Schedule to Estimate Bad Debts and...Ch. 8 - Accounting for Receivables and Uncollectible...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Average Uncollectible Account Losses and Bad Debt Expense The accountant for Porile Company prepared the following data for sales and losses from uncollectible accounts: Required: 1. Calculate the average percentage of losses from uncollectible accounts for 2015 through 2018. 2. Assume that the credit sales for 2019 are $1,260,000 and that the weighted average percentage calculated in Requirement 1 is used as an estimate of loses from uncollectible accounts for 2019 credit sales. Determine the bad debt expense for 2019 using the percentage of credit sales method. 3. CONCEPTUAL CONNECTION Do you believe this estimate of bad debt expense is reasonable? 4. CONCEPTUAL CONNECTION How would you estimate 2019 bad debt expense if losses from uncollectible accounts for 2018 were What other action would management consider?arrow_forwardThe following accounts receivable information pertains to Luxury Cruises. A. Determine the estimated uncollectible bad debt for Luxury Cruises in 2018 using the balance sheet aging of receivables method. B. Record the year-end 2018 adjusting journal entry for bad debt. C. Assume there was a previous debit balance in Allowance for Doubtful Accounts of $187,450; record the year-end entry for bad debt, taking this into consideration. D. Assume there was a previous credit balance in Allowance for Doubtful Accounts of $206,770; record the year-end entry for bad debt, taking this into consideration. E. On January 24, 2019, Luxury Cruises identifies Landon Walkers account as uncollectible in the amount of $4,650. Record the entry for identification.arrow_forwardMillennium Associates records bad debt using the allowance, income statement method. They recorded $299,420 in accounts receivable for the year, and $773,270 in credit sales. The uncollectible percentage is 3.2%. On February 5, Millennium Associates identifies one uncollectible account from Molar Corp in the amount of $1,330. On April 15, Molar Corp unexpectedly pays its account in full. Record journal entries for the following. A. Year-end adjusting entry for 2017 bad debt B. February 5, 2018 identification entry C. Entry for payment on April 15, 2018arrow_forward

- The following accounts receivable information pertains to Marshall Inc. Determine the estimated uncollectible bad debt from Marshall Inc. using the balance sheet aging of receivables method, and record the year-end adjusting journal entry for bad debt.arrow_forwardThe following accounts receivable information pertains to Select Distributors. A. Determine the estimated uncollectible bad debt for Select Distributors in 2018 using the balance sheet aging of receivables method. B. Record the year-end 2018 adjusting journal entry for bad debt. C. Assume there was a previous debit balance in Allowance for Doubtful Accounts of $233,180; record the year-end entry for bad debt, taking this into consideration. D. Assume there was a previous credit balance in Allowance for Doubtful Accounts of $199,440; record the year-end entry for bad debt, taking this into consideration. E. On March 21, 2019, Select Distributors identifies Aida Normans account as uncollectible in the amount of $10,890. Record the entry for identification.arrow_forwardMillennium Associates records bad debt using the allowance, balance sheet method. They recorded $299,420 in accounts receivable for the year, and $773,270 in credit sales. The uncollectible percentage is 3.2%. On November 22, Millennium Associates identifies one uncollectible account from Angels Hardware in the amount of $3,650. On December 18, Angels Hardware unexpectedly pays its account in full. Record journal entries for the following. A. Year-end adjusting entry for 2017 bad debt B. November 22, 2018 identification entry C. Entry for payment on December 18, 2018arrow_forward

- Allowance Method of Accounting for Bad Debts—Comparison of the Two Approaches Kandel Company had the following data available for 2016 (before making any adjustments): Required Prepare the journal entry to recognize bad debts under the following assumptions: (a) bad debts expense is expected to be 2% of net credit sales for the year and (b) Kandel expects it will not be able to collect 6% of the balance in accounts receivable at year-end. Assume instead that the balance in the allowance account is a $2,600 debit. How will this affect your answers to part (1)?arrow_forwardJars Plus recorded $861,430 in credit sales for the year and $488,000 in accounts receivable. The uncollectible percentage is 2.3% for the income statement method, and 3.6% for the balance sheet method. A. Record the year-end adjusting entry for 2018 bad debt using the income statement method. B. Record the year-end adjusting entry for 2018 bad debt using the balance sheet method. C. Assume there was a previous debit balance in Allowance for Doubtful Accounts of $10,220, record the year-end entry for bad debt using the income statement method, and then the entry using the balance sheet method. D. Assume there was a previous credit balance in Allowance for Doubtful Accounts of $5,470, record the year-end entry for bad debt using the income statement method, and then the entry using the balance sheet method.arrow_forwardInk Records recorded $2,333,898 in credit sales for the year and $1,466,990 in accounts receivable. The uncollectible percentage is 3% for the income statement method and 5% for the balance sheet method. A. Record the year-end adjusting entry for 2018 bad debt using the income statement method. B. Record the year-end adjusting entry for 2018 bad debt using the balance sheet method. C. Assume there was a previous credit balance in Allowance for Doubtful Accounts of $20,254; record the year-end entry for bad debt using the income statement method, and then the entry using the balance sheet method.arrow_forward

- Funnel Direct recorded $1,345,780 in credit sales for the year and $695,455 in accounts receivable. The uncollectible percentage is 4.4% for the income statement method and 4% for the balance sheet method. A. Record the year-end adjusting entry for 2018 bad debt using the income statement method. B. Record the year-end adjusting entry for 2018 bad debt using the balance sheet method. C. Assume there was a previous credit balance in Allowance for Doubtful Accounts of $13,888; record the year-end entry for bad debt using the income statement method, and then the entry using the balance sheet method.arrow_forwardClovis Enterprises reports $845,500 in credit sales for 2018 and $933,000 in 2019. It has a $758,000 accounts receivable balance at the end of 2018 and $841,000 at the end of 2019. Clovis uses the income statement method to record bad debt estimation at 4% during 2018. To manage earnings more favorably, Clovis changes bad debt estimation to the balance sheet method at 5% during 2019. A. Determine the bad debt estimation for 2018. B. Determine the bad debt estimation for 2019. C. Describe a benefit to Clovis Enterprises in 2019 as a result of its earnings management.arrow_forwardFortune Accounting reports $1,455,000 in credit sales for 2018 and $1,678,430 in 2019. It has an $825,000 accounts receivable balance at the end of 2018 and $756,000 at the end of 2019. Fortune uses the balance sheet method to record bad debt estimation at 7.5% during 2018. To manage earnings more favorably, Fortune changes bad debt estimation to the income statement method at 5.5% during 2019. A. Determine the bad debt estimation for 2018. B. Determine the bad debt estimation for 2019. C. Describe a benefit to Fortune in 2019 as a result of its earnings management.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Accounts Receivable and Accounts Payable; Author: The Finance Storyteller;https://www.youtube.com/watch?v=x_aUWbQa878;License: Standard Youtube License