College Accounting (Book Only): A Career Approach

13th Edition

ISBN: 9781337280570

Author: Scott, Cathy J.

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 8, Problem 6E

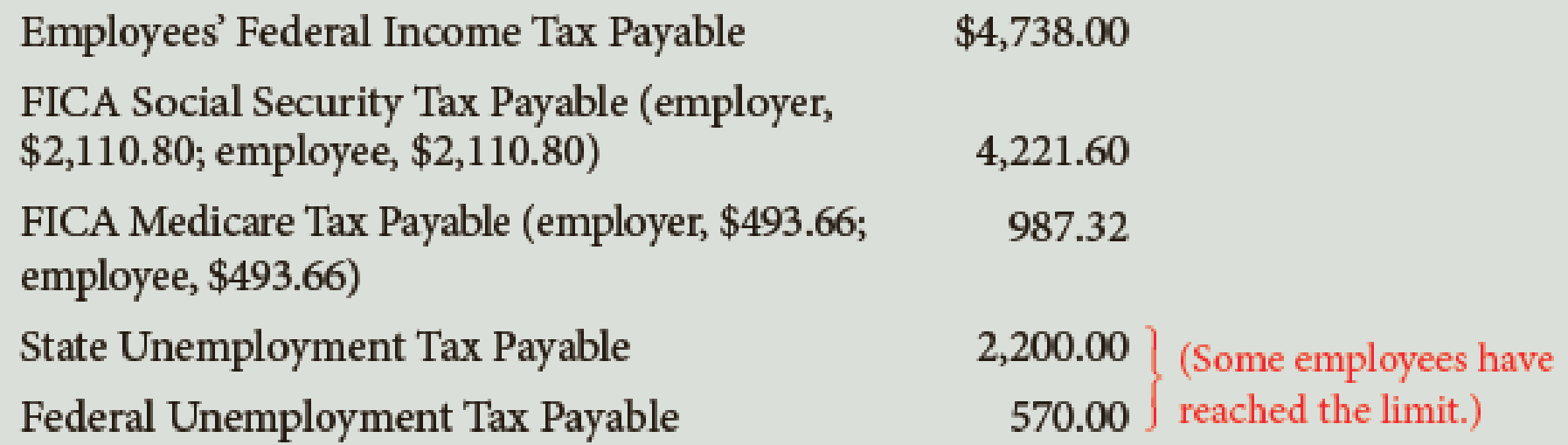

On September 30, Cody Company’s selected account balances are as follows:

In general journal form, prepare the entries to record the following:

Oct. 15 Payment of liabilities for FICA taxes and the federal income tax.

31 Payment of liability for state

31 Payment of liability for federal unemployment tax.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Nix Company had the following balances in its general ledger before the entries for requirement (1) were made:

Employee federal income tax payable

$2,500

Social Security tax payable

2,008

Medicare tax payable

470

FUTA tax payable

520

SUTA tax payable

4,510

a. Prepare the journal entry for payment of the liabilities for federal income taxes and Social Security and Medicare taxes on April 15, 20--.

b. Prepare the journal entry for payment of the liability for FUTA tax on April 30, 20--.

c. Prepare the journal entry for payment of the liability for SUTA tax on April 30, 20--.

According to the accountant of Sheridan Inc., its payroll taxes for the week were as follows: $132.00 for FICA taxes, $13,20 for federal

unemployment taxes, and $92.40 for state unemployment taxes.

Journalize the entry to record the accrual of the payroll taxes. (Credit account titles are automatically indented when the amount is

entered. Do not indent manually)

Account Titles and Explanation

Debit

Credit

Journalize each of the payroll transactions listed below. Post all entries except the last two to the appropriate general ledger accounts.

The journal page and the ledger accounts are supplied below. The balances listed in the general ledger accounts for Cash, FUTA Taxes Payable, SUTA Taxes Payable, Employees SIT Payable, Wages and Salaries, and Payroll Taxes are the results of all payroll transactions for the first quarter, not including the last pay of the quarter. The balances in FICA Taxes Payable—OASDI, FICA Taxes Payable—HI, and Employees FIT Payable are the amounts due from the March 15 payroll.

March 31, 20--: Paid total wages of $9,350.00. These are the wages for the last semimonthly pay of March. All of this amount is taxable under FICA (OASDI and HI). In addition, withhold $1,175 for federal income taxes and $102.03 for state income taxes. These are the only deductions made from the employees' wages.

March 31, 20--: Record the employer's payroll taxes for the last pay in…

Chapter 8 Solutions

College Accounting (Book Only): A Career Approach

Ch. 8 - Prob. 1QYCh. 8 - Prob. 2QYCh. 8 - Prob. 3QYCh. 8 - Prob. 4QYCh. 8 - Prob. 5QYCh. 8 - Prob. 6QYCh. 8 - Prob. 7QYCh. 8 - Prob. 8QYCh. 8 - Prob. 9QYCh. 8 - Prob. 1DQ

Ch. 8 - Prob. 2DQCh. 8 - Prob. 3DQCh. 8 - Prob. 4DQCh. 8 - Prob. 5DQCh. 8 - Prob. 6DQCh. 8 - Prob. 7DQCh. 8 - Prob. 8DQCh. 8 - Prob. 9DQCh. 8 - Prob. 1ECh. 8 - Prob. 2ECh. 8 - Prob. 3ECh. 8 - Prob. 4ECh. 8 - Prob. 5ECh. 8 - On September 30, Cody Companys selected account...Ch. 8 - On September 30, Hilltop Companys selected payroll...Ch. 8 - Prob. 8ECh. 8 - Prob. 1PACh. 8 - Prob. 2PACh. 8 - Prob. 3PACh. 8 - Prob. 4PACh. 8 - Prob. 5PACh. 8 - Prob. 1PBCh. 8 - Prob. 2PBCh. 8 - Prob. 3PBCh. 8 - Prob. 4PBCh. 8 - Prob. 5PBCh. 8 - TruGreen is the worlds largest lawn and landscape...Ch. 8 - Between the end of one month and the 15th day of...

Additional Business Textbook Solutions

Find more solutions based on key concepts

This year, Prewer Inc. received a 160,000 dividend on its investment consisting of 16 percent of the outstandin...

Principles Of Taxation For Business And Investment Planning 2020 Edition

Bank loan; accrued interest LO132 On October 1, Eder Fabrication borrowed 60 million and issued a nine-month, ...

Intermediate Accounting

Place the letter of the appropriate accounting cost in Column 2 in the blank next to each decision category in ...

Fundamentals Of Cost Accounting (6th Edition)

Using the information from Problem 1-2B and the inventory information for the Best Bikes below, complete the re...

Managerial Accounting

E6-14 Using accounting vocabulary

Learning Objective 1, 2

Match the accounting terms with the corresponding d...

Horngren's Accounting (11th Edition)

Discussion Analysis A13-41 Discussion Questions 1. How do managers use the statement of cash flows? 2. Describ...

Managerial Accounting (4th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On September 30, Hilltop Companys selected payroll accounts are as follows: Prepare general journal entries to record the following: Oct. 15 Payment of federal tax deposit of FICA taxes and the federal income tax. 31 Payment of state unemployment tax. 31 Payment of federal unemployment tax.arrow_forwardThe totals line from Nix Companys payroll register for the week ended March 31, 20--, is as follows: Payroll taxes are imposed as follows: Social Security tax, 6.2%; Medicare tax, 1.45%; FUTA tax, 0.6%; and SUTA tax, 5.4%. REQUIRED 1. a. Prepare the journal entry for payment of this payroll on March 31, 20--. b. Prepare the journal entry for the employers payroll taxes for the period ended March 31, 20--. 2. Nix Company had the following balances in its general ledger before the entries for requirement ( 1 ) were made: a. Prepare the journal entry for payment of the liabilities for federal income taxes and Social Security and Medicare taxes on April 15, 20--. b. Prepare the journal entry for payment of the liability for FUTA tax on April 30, 20--. c. Prepare the journal entry for payment of the liability for SUTA tax on April 30, 20--.arrow_forwardThe following information about the payroll for the week ended December 30 was obtained from the records of Qualitech Co.: Tax rates assumed: Social security, 6% Medicare, 1.5% State unemployment (employer only), 5.4% Federal unemployment (employer only), 0.8% Instructions 1. Assuming that the payroll for the last week of the year is to be paid on December 31, journalize the following entries: a. December 30, to record the payroll. b. December 30, to record the employers payroll taxes on the payroll to be paid on December 31. Of the total payroll for the last week of the year, 35,000 is subject to unemployment compensation taxes. 2. Assuming that the payroll for the last week of the year is to be paid on January 5 of the following fiscal year, journalize the following entries: a. December 30, to record the payroll. b. January 5, to record the employers payroll taxes on the payroll to be paid on January 5. Because it is a new fiscal year, all 675,000 in salaries is subject to unemployment compensation taxes.arrow_forward

- Recording payroll and payroll taxes. Assume that the company is subject to a 2% state unemployment tax and 0.6% federal unemployment tax. REQUIRED: Record the following in general journal entry form on May 31. A. Accrual of monthly payroll B. Payment of the net payroll C. Accrual of employers payroll taxes(assume that the FICA matches the amount withhold) D. Payment of these payroll related liabilities. (assume that all are settled at the same time) The options for the shaded drop boxes are : Administrative salaries expense, cash, custodial salaries expense, federal income tax withholding payable, federal unemployment tax payable, FICA tax payable, payroll payable, payroll tax expense, sales salaries expense, state unemployment tax payable.arrow_forwardInstructions According to a summary of the payroll of Mountain Streaming Co., $770,000 was subject to the 6.0% social security tax and the 1.5% Medicare tax. Also, $42,000 was subject to state and federal unemployment taxes. Required: A. Calculate the employer's payroll taxes, using the following rates: state unemployment, 5.4%; federal unemployment, 0.8%. B. Journalize the entry to record the accrual of payroll taxes. Refer to the Chart of Accounts for exact wording of account titles.arrow_forwardThe following information about the payroll for the week ended December 30 was obtained from the records of Boltz Co.:Required:1. Assuming that the payroll for the last week of the year is to be paid on December 31, journalize the following entries (refer to the Chart of Accounts for exact wording of account titles):a. December 30, to record the payroll.b. December 30, to record the employer’s payroll taxes on the payroll to be paid on December 31. Of the total payroll for the last week of the year, $44,000 is subject to unemployment compensation taxes.2. Assuming that the payroll for the last week of the year is to be paid on January 5 of the following fiscal year, journalize the following entries (refer to the Chart of Accounts for exact wording of account titles):a. On page 11 of the journal: December 30, to record the payroll.b. On page 12 of the journal: January 5, to record the employer's payroll taxes on the payroll to be paid on January 5. Since it is a new fiscal year, all…arrow_forward

- Rand Company’s payroll on December 31 of the current year is as follows: Prepare the journal entries for Rand’s payroll and payroll taxes.arrow_forward2. Nix Company had the following balances in its general ledger before the entries for requirement (1) were made: Employee federal income tax payable $2,500 Social Security tax payable 2,008 Medicare tax payable 470 FUTA tax payable 520 SUTA tax payable 4,510 a. Prepare the journal entry for payment of the liabilities for federal income taxes and Social Security and Medicare taxes on April 15, 20--.arrow_forwardThe payroll register of Seaside Architecture Company indicates $910 of social security and $251 of Medicare tax withheld on total salaries of $15,500 for the period. Federal withholding for the period totaled $3,250. Required: Prepare the journal entry for the period’s payroll. Refer to the Chart of Accounts for exact wording of account titles. Chart Of Accounts CHART OF ACCOUNTS Seaside Architecture Company General Ledger ASSETS 110 Cash 111 Accounts Receivable 112 Interest Receivable 113 Notes Receivable 115 Merchandise Inventory 116 Supplies 118 Prepaid Insurance 120 Land 123 Building 124 Accumulated Depreciation-Building 125 Office Equipment 126 Accumulated Depreciation-Office Equipment LIABILITIES 210 Accounts Payable 213 Interest Payable 214 Notes Payable 221 Salaries Payable 222 Social Security Tax Payable 223 Medicare Tax Payable 224 Employees Federal Income Tax Payable…arrow_forward

- The payroll register of Seaside Architecture Company indicates $960 of social security and $260 of Medicare tax withheld on total salaries of $17,000 for the period. Federal withholding for the period totaled $3,245. Required: Prepare the journal entry for the period’s payroll. Refer to the Chart of Accounts for exact wording of account titles. Chart Of Accounts CHART OF ACCOUNTS Seaside Architecture Company General Ledger ASSETS 110 Cash 111 Accounts Receivable 112 Interest Receivable 113 Notes Receivable 115 Inventory 116 Supplies 118 Prepaid Insurance 120 Land 123 Building 124 Accumulated Depreciation-Building 125 Office Equipment 126 Accumulated Depreciation-Office Equipment LIABILITIES 210 Accounts Payable 213 Interest Payable 214 Notes Payable 221 Salaries Payable 222 Social Security Tax Payable 223 Medicare Tax Payable 224 Employees Federal Income Tax Payable 225 Employee…arrow_forwardThe following totals for the month of June were taken from the payroll register of Arcon Company: Account Debit Credit Salaries expense $13,980.00 Social security and Medicare taxes withheld 1,048.50 Income taxes withheld 333.00 Retirement savings 501.00 The entry to journalize the payment of net pay would include a a. debit to Salaries Payable for $13,980.00. b. credit to Salaries Payable for $12,097.50. c. debit to Salaries Payable for $12,097.50. d. credit to Salaries Expense for $12,097.50.arrow_forwardPhoebe Corporation signed a six-month note payable on October 23, 2018. What accountsrelating to the note payable will be reported on its financial statements for the fiscal yearending December 31, 2018?a. Notes payable and interest payable will be reported on the balance sheet.b. Notes payable will be reported on the balance sheet and interest payable will be reportedon the income statement.c. Notes payable, interest payable, and interest expense will be reported on the balancesheet.d. Interest receivable will be reported on the balance sheet and notes payable will bereported on the income statement.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...

Accounting

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

How JOURNAL ENTRIES Work (in Accounting); Author: Accounting Stuff;https://www.youtube.com/watch?v=Y-_Q3rANyxU;License: Standard Youtube License