Concept explainers

1.

Prepare the

1.

Explanation of Solution

Prepare the journal entry to record the sales made during October:

| Date | Account Titles and Explanations | Debit ($) | Credit ($) |

| October | Cash or Accounts receivable | 58,800 | |

| Sales | 58,800 | ||

| (To record the sale of 21,000 cereal boxes) |

Table (1)

Prepare the journal entry to record the purchase of shovel set:

| Date | Account Titles and Explanations | Debit ($) | Credit ($) |

| October | Inventory of premiums | 2,640 | |

| Cash | 2,640 | ||

| (To record the purchase of toy shovel sets) |

Table (2)

Prepare the journal entry to record the estimated total premium liability:

| Date | Account Titles and Explanations | Debit ($) | Credit ($) |

| October | Premium expenses (2) | 2,940 | |

| Estimated premium liability | 2,940 | ||

| (To record the recognition of estimated premium liability) |

Table (3)

Working note (1):

Calculate the total box tops estimated for redemption:

| Particulars | Amount ($) | Amount ($) |

| Total box tops outstanding in October 2016 (A) | 21,000 | |

| Estimated percent redeemed (B) | 70% | |

| Total box tops estimated for redemption (C) | 14,700 |

Table (4)

Working note (2):

Calculate the amount of premium expenses:

Prepare the journal entry to record the redemption of 12,000 top boxes in October:

| Date | Account Titles and Explanations | Debit ($) | Credit ($) |

| October | Estimated premium liability (3) | 2,400 | |

| Inventory of premiums | 2,400 | ||

| (To record the redemption of 12,000 top boxes of cereals) |

Table (5)

Working note (3):

Calculate the amount of estimated premium liability:

Prepare the journal entry to record the sales made during November:

| Date | Account Titles and Explanations | Debit ($) | Credit ($) |

| November | Cash or Accounts receivable | 67,200 | |

| Sales | 67,200 | ||

| (To record the sale of 24,000 cereal boxes) |

Table (6)

Prepare the journal entry to record the purchase of shovel set:

| Date | Account Titles and Explanations | Debit ($) | Credit ($) |

| November | Inventory of premiums | 3,249 | |

| Cash | 3,249 | ||

| (To record the purchase of toy shovel sets) |

Table (7)

Prepare the journal entry to record the estimated total premium liability:

| Date | Account Titles and Explanations | Debit ($) | Credit ($) |

| November | Premium expenses (4) | 3,360 | |

| Estimated premium liability | 3,360 | ||

| (To record the recognition of estimated premium liability) |

Table (8)

Working note (3):

Calculate the total box tops estimated for redemption:

| Particulars | Amount ($) | Amount ($) |

| Total box tops outstanding in November 2016 (A) | 24,000 | |

| Estimated percent redeemed (B) | 70% | |

| Total box tops estimated for redemption (C) | $16,800 |

Table (9)

Working note (4):

Calculate the amount of premium expenses:

Prepare the journal entry to record the redemption of 16,005 top boxes in October:

| Date | Account Titles and Explanations | Debit ($) | Credit ($) |

| October | Estimated premium liability (5) | 3,201 | |

| Inventory of premiums | 3,201 | ||

| (To record the redemption of 16,005 top boxes of cereals) |

Table (10)

Working note (5):

Calculate the amount of estimated premium liability:

Prepare the journal entry to record the sales made during December:

| Date | Account Titles and Explanations | Debit ($) | Credit ($) |

| December | Cash or Accounts receivable | 92,400 | |

| Sales | 92,400 | ||

| (To record the sale of 33,000 cereal boxes) |

Table (11)

Prepare the journal entry to record the purchase of shovel set:

| Date | Account Titles and Explanations | Debit ($) | Credit ($) |

| December | Inventory of premiums | 5,091 | |

| Cash | 5,091 | ||

| (To record the purchase of toy shovel sets) |

Table (12)

Prepare the journal entry to record the estimated total premium liability:

| Date | Account Titles and Explanations | Debit ($) | Credit ($) |

| November | Premium expenses (7) | 4,620 | |

| Estimated premium liability | 4,620 | ||

| (To record the recognition of estimated premium liability) |

Table (13)

Working note (6):

Calculate the total box tops estimated for redemption:

| Particulars | Amount ($) | Amount ($) |

| Total box tops outstanding in December 2016 (A) | 33,000 | |

| Estimated percent redeemed (B) | 70% | |

| Total box tops estimated for redemption (C) | $23,100 |

Table (14)

Working note (7):

Calculate the amount of premium expenses:

Prepare the journal entry to record the redemption of 20,475 top boxes in October:

| Date | Account Titles and Explanations | Debit ($) | Credit ($) |

| October | Estimated premium liability (8) | 4,149 | |

| Inventory of premiums | 4,149 | ||

| (To record the redemption of 20,475 top boxes of cereals) |

Table (15)

Working note (8):

Calculate the amount of estimated premium liability:

2.

Indicate the way in which the inventory of premiums and the estimated liability would be disclosed in the ending balance sheets of Company YC for the months October, November and December.

2.

Explanation of Solution

Prepare the partial balance sheet to record the inventory of premiums and the estimated liability:

| Company YC | |||

| Balance Sheet Statement (Partial) | |||

| At The End of | |||

| Assets | October | November | December |

| Current assets: | |||

| Inventory of premiums | $240 | $288 | $1,230 |

| Liabilities | October | November | December |

| Current liabilities: | |||

| Estimated premium liability | $540 | $699 | $1,170 |

Table (16)

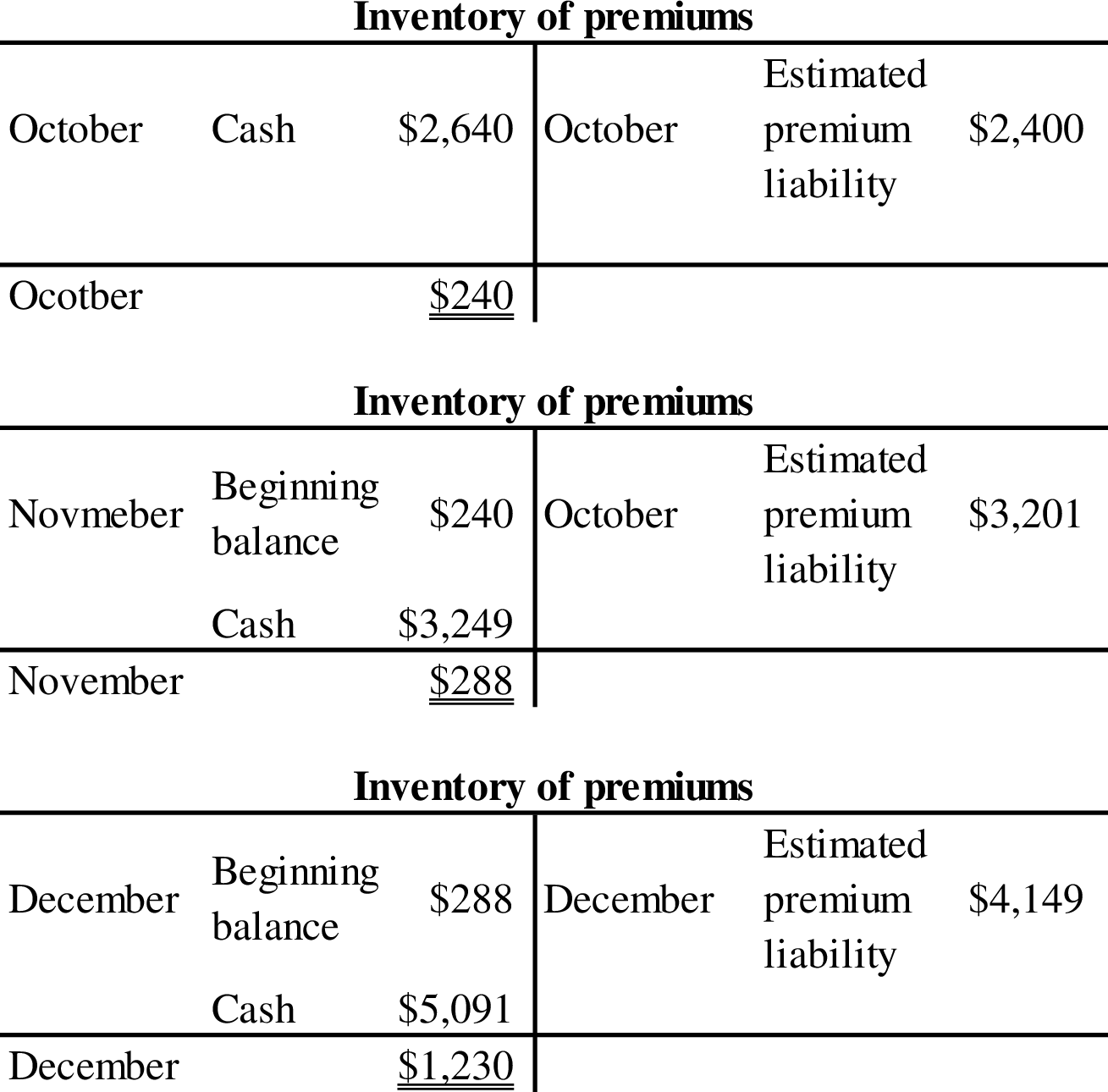

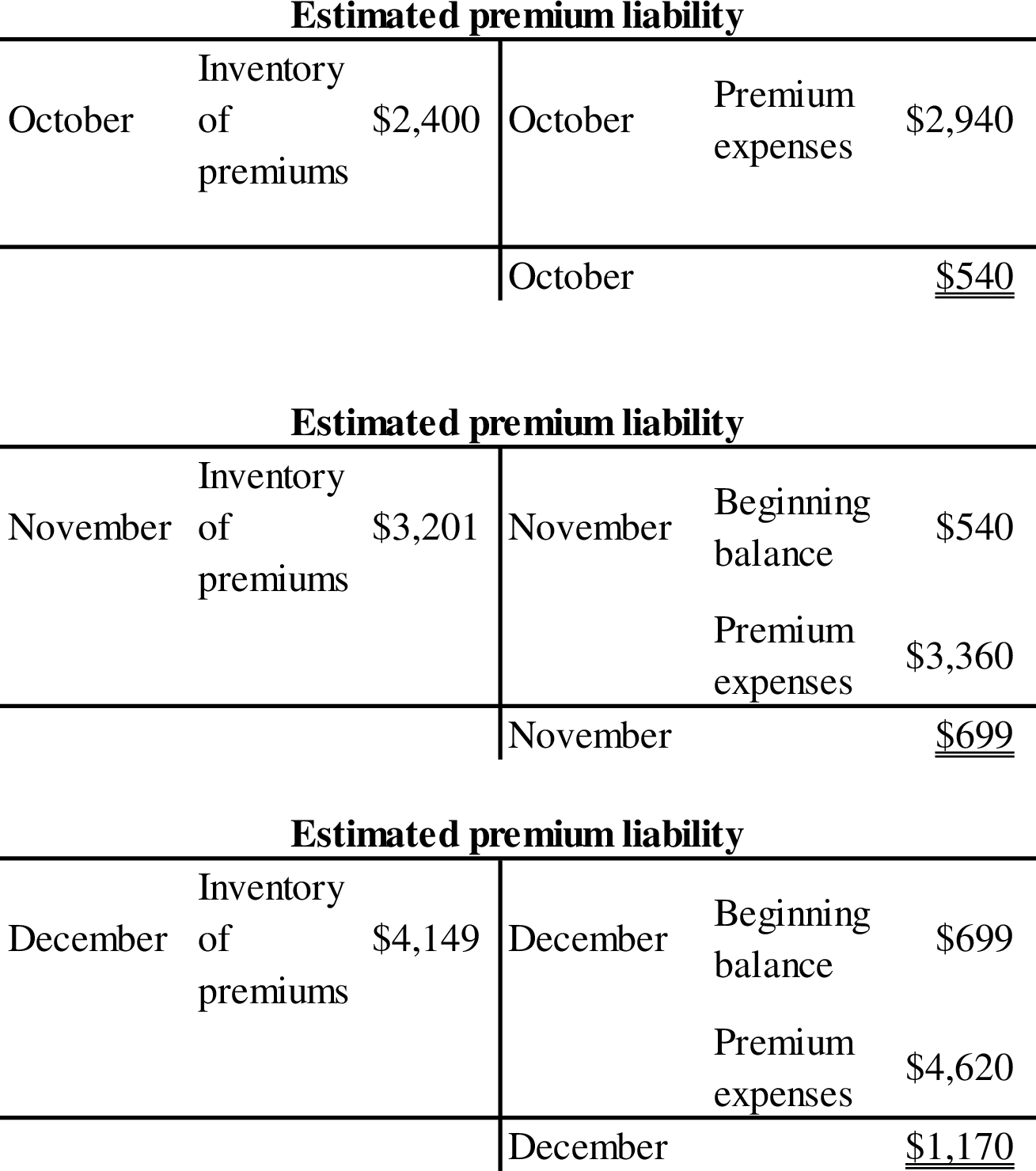

Prepare the T-accounts to determine the estimated premium liability and inventory of premiums:

Want to see more full solutions like this?

Chapter 9 Solutions

EBK INTERMEDIATE ACCOUNTING: REPORTING

- A home gods retailer offers a sales incentive program where customers receive credit towards future purchases based on the dollar amount of their purchases today. For every $10 spent, a customer receives a $1 credit to use in the next 30 days. Based upon historical trends, the firm estimates that 35% of the credits will be redeemed. Assume the credit associated with the sales incentive program is a separate performance obligation. If during the month the company sold $40,000 of product with a cost of $22,000, what is amount of revenue allocated to product sales? Round to the nearest dollar. $29,630 $36,364 $38,647 $40,000 None of the abovearrow_forwardCarla Vista Choice sells natural supplements to customers with an unconditional sales return if they are not satisfied. The sales returns extends 60 days. On February 10, 2021, a customer purchases on account $3500 of products (cost $1750). Assuming that based on prior experience, estimated returns are 20%. The journal entry to record the expected sales return includes a debit to Cash and a credit to Sales Revenue of $3500. debit to Sales Returns and Allowance of $700 and a credit to Allowance for Sales Returns and Allowances of $700. credit to Estimated Inventory Returns of $350. debit to Cost of Goods Sold and credit to Inventory for $1750.arrow_forwardClipClop Company sells horseshoes to customers at a discount of 4% if the customer orders more than 10,000 horseshoes in a year. The price per shoe is $2. In April, Oats Company orders 4,000 horseshoes from ClipClop. Based on past experience with Oats Company, ClipClop expects Oats to meet the volume threshold of 10,000 horseshoes by the end of the year. What amount of revenue should ClipClop record in connection with the April sale? $7,680 $20,000 $0 because ClipClop does not know if Oats will meet the volume discount threshold $8,000arrow_forward

- 1. The bookstore at State University purchases jackets sporting the school name and logo from a vendor. The vendor sells the jackets to the store for P1900 apiece. The cost to the bookstore for placing an order is P6000, and the carrying cost is 25% of the purchase price. The bookstore manager estimates that 1,700 jackets will be sold during the year. The vendor has offered the bookstore the following volume discount schedule: Order Size Discount % 12 to 299 300 to 499 2 500 to 799 4 800 and over The bookstore manager wants to determine the bookstore's optimal order quantity, given the foregoing quantity discount information.arrow_forwardBotanic Choice sell natural supplements to customers with an unconditional right of return if they are not satisfied. The right of returns extends 60 days. On February 10, 2020, a customer purchases P30,000 of products (cost P15,000). Assuming that based on prior experience, estimated returns are 20%. The journal entry to record the sale and cost of goods sold includes aarrow_forwardYour answer is partially correct. Nash Taco Palace sells 320 gift cards at $60 per gift card and 160 of the gift cards are redeemed by year-end. Nash estimates that it will have 10% breakage on its gift cards. Prepare the entry for the gift card redemption and the expected breakage for the gift cards in the current year. (Ignore Cost of Goods Sold.) (If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. List oll debit entries before credit entries. Round intermediate calculations to 4 decimal places, eg. 0.2456 and final answers to 0 decimal places, eg. 5,125) Account Titles and Explanation Unearned Gift Card Revenue Sales Revenue Sales Revenue (Breakage) eTextbook and Media. Debit Credit 9600arrow_forward

- Anton Company sells one dozen doughnuts for P500 per box. There is a promotion wherein if a customer buys 3 boxes in a single transaction, a customer received a coupon for one additional box for free. Customers can redeem coupons at any time following the month of sale of the 3 boxes before the expiration date. It is expected 60% of the customers will redeem the coupons. During 2022, the entity sold 15,000 boxes at P500 per box or P7,500,000. During 2023, the entity delivered 2,000 free additional boxes to the customers. Required: 1. Compute the stand-alone selling price of the coupons. 2. Allocate the transaction price to the products sold and the coupons. 3. Prepare the journal entry to record the sale of the products and issue of the free product coupons in 2022 4. Prepare the journal entry to record the delivery of 2,000 free additional boxes in 2023.arrow_forwardMarin Shed Solutions sells its largest shed for $1,100 plus HST of 13 %. On May 10, 2024, it sold 26 of these sheds. On May 17,2024, the company sold 85 of these sheds. All sales are cash sales. For each day's sales, calculate the HST. May 10, 2024 May 17, 2024 Question Part Score $ Date $ HST payable Prepare a journal entry to record the sales. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries. Record journal entries in the order presented in the problem.) Account Titles Debit --/2 Creditarrow_forwardA retailer anticipates selling 3,000 units of its product at a uniform rate over the next year. Each time the retailer places an order for a units, it is charged a flat fee of $50. Carrying costs are S30 per unit per year. How many times should the retailer reorder each year and what should be the lot size to mınımize inventory costs? What is the minimum inventory cost? Use the formula ECQ to obtain your answers. They should order times a year units The minimum inventory cost is $arrow_forward

- The Junior Achievers Club maintains an inventory of chocolate bars to meet its annual demand for 100,000 bars to service customers. Each bar costs $5.00, and cost per order is $100.00. Carrying costs have been identified as $1.50 per bar. Recently, the supplier has offered the company a 6.5% discount if orders are placed semi-annually. Show all calculations in answering questions below. Required: What will be Achievers Club’s total inventory costs if it utilizes EOQ?arrow_forwardProblem 2: JIN Corporation started a promotional program. A towel is offered as a premium to customers who send in 10 box tops of facial soap returned and a remittance of P25. Distribution cost is P10 per towel. The entity estimated that only 60% of the box tops reaching the market will be redeemed. The entity provided the following information: 2020 2021 Facial soap sales, P50 per unit Towel purchases, P90 per unit Number of box tops returned 2,500,000 2,875,000 337,500 360,000 38,550 22,500 Requirements: 4. Compute for the premiums (as an asset) amount for the year ended: A. December 31, 2020 B. December 31, 2021 2 AE211: Intermediate Acctg. 2 Prepared by: Bernadette Adelaida M. Cope 5. Compute for the premiums expense for the year ended: A. December 31, 2020 B. December 31, 2021 6. Compute for the premium liability for the year ended: A. December 31, 2020 B. December 31, 2021 7. How much net cash did the entity receive (give) with regards to the premium transactions for the year…arrow_forwardProblem 2: JIN Corporation started a promotional program. A towel is offered as a premium to customers who send in 10 box tops of facial soap returned and a remittance of P25. Distribution cost is P10 per towel. The entity estimated that only 60% of the box tops reaching the market will be redeemed. The entity provided the following information: 2020 2021 Facial soap sales, P50 per unit Towel purchases, P90 per unit Number of box tops returned 2,500,000 2,875,000 337,500 360,000 22,500 38,550 Requirements: How much net cash did the entity receive (give) with regards to the premium transactions for the year given below? (if net cash outflow, put a negative (-) sign before the numerical figure. A. December 31, 2020 B. December 31, 2021 7.arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning