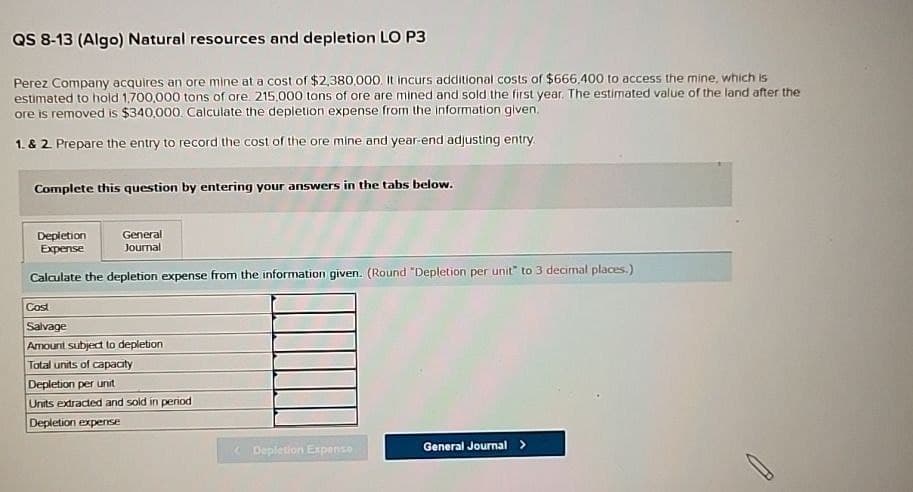

QS 8-13 (Algo) Natural resources and depletion LO P3 Perez Company acquires an ore mine at a cost of $2,380,000. It incurs additional costs of $666,400 to access the mine, which is estimated to hold 1,700,000 tons of ore 215,000 tons of ore are mined and sold the first year. The estimated value of the land after the ore is removed is $340,000. Calculate the depletion expense from the information given. 1. & 2. Prepare the entry to record the cost of the ore mine and year-end adjusting entry. Complete this question by entering your answers in the tabs below. Depletion Expense General Journal Calculate the depletion expense from the information given. (Round "Depletion per unit" to 3 decimal places.) Cost Salvage Amount subject to depletion Total units of capacity Depletion per unit Units extracted and sold in period Depletion expense Depletion Expense General Journal >

QS 8-13 (Algo) Natural resources and depletion LO P3 Perez Company acquires an ore mine at a cost of $2,380,000. It incurs additional costs of $666,400 to access the mine, which is estimated to hold 1,700,000 tons of ore 215,000 tons of ore are mined and sold the first year. The estimated value of the land after the ore is removed is $340,000. Calculate the depletion expense from the information given. 1. & 2. Prepare the entry to record the cost of the ore mine and year-end adjusting entry. Complete this question by entering your answers in the tabs below. Depletion Expense General Journal Calculate the depletion expense from the information given. (Round "Depletion per unit" to 3 decimal places.) Cost Salvage Amount subject to depletion Total units of capacity Depletion per unit Units extracted and sold in period Depletion expense Depletion Expense General Journal >

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter7: Operating Assets

Section: Chapter Questions

Problem 38BE

Related questions

Question

Transcribed Image Text:QS 8-13 (Algo) Natural resources and depletion LO P3

Perez Company acquires an ore mine at a cost of $2,380,000. It incurs additional costs of $666,400 to access the mine, which is

estimated to hold 1,700,000 tons of are. 215,000 tons of ore are mined and sold the first year. The estimated value of the land after the

ore is removed is $340,000. Calculate the depletion expense from the information given.

1. & 2. Prepare the entry to record the cost of the ore mine and year-end adjusting entry.

Complete this question by entering your answers in the tabs below.

Depletion

Expense

General

Journal

Calculate the depletion expense from the information given. (Round "Depletion per unit" to 3 decimal places.)

Cost

Salvage

Amount subject to depletion

Total units of capacity

Depletion per unit

Units extracted and sold in period

Depletion expense

<Depletion Expense

General Journal >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning