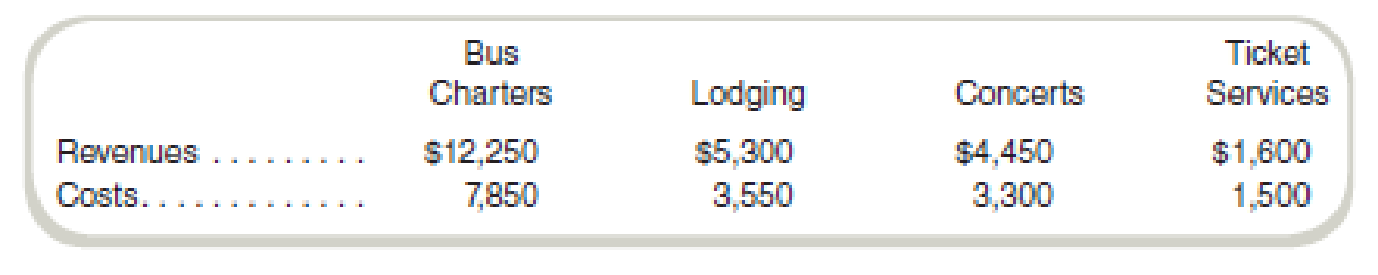

Midwest Entertainment has four operating divisions: Bus Charters, Lodging, Concerts, and Ticket Services. Each division is a separate segment for financial reporting purposes. Revenues and costs related to outside transactions were as follows for the past year (dollars in thousands):

Bus Charters Division participates in a frequent guest program with Lodging Division. During the past year, Bus Charters reported that it traded lodging award coupons for travel that had a retail value of $1.3 million, assuming that the travel was redeemed at full fares. Concerts Division offered 20 percent discounts to Midwest’s bus passengers and lodging guests. These discounts to bus passengers were estimated to have a retail value of $350,000. Midwest’s lodging guests redeemed $150,000 in concert discount coupons. Midwest’s hotels also provided rooms for Bus Charters’s employees (drivers and guides). The value of the rooms for the year was $650,000.

Ticket Services Division sold chartered tours for Bus Charters valued at $200,000 for the year. This service for intracompany lodging was valued at $100,000. It also sold concert tickets for Concerts; tickets for intracompany concert admission were valued at $50,000.

While preparing all of these data for financial statement presentation, Lodging Division’s controller stated that the value of the bus coupons should be based on their differential and opportunity costs, not on the full fare. This argument was supported because travel coupons are usually allocated to seats that would otherwise be empty or that are restricted similar to those on discount tickets. If the differential and opportunity costs were used for this transfer price, the value would be $250,000 instead of $1.3 million. Bus Charters’s controller made a similar argument concerning the concert discount coupons. If the differential cost basis were used for the concert coupons, the transfer price would be $50,000 instead of the $350,000.

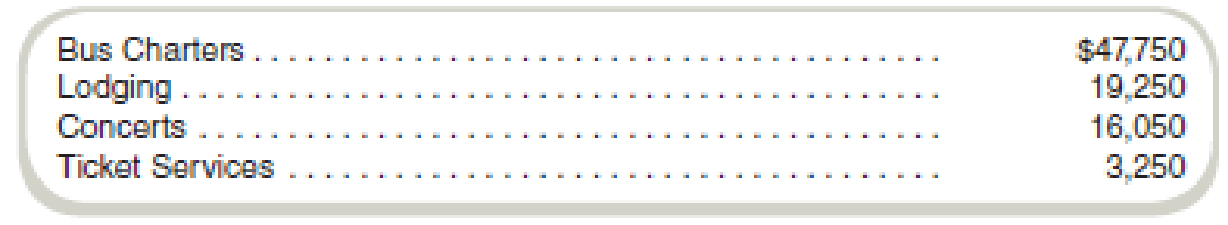

Midwest reports assets in each division as follows (dollars in thousands):

Required

- a. Using the retail values for transfer pricing for segment reporting purposes, what are the operating profits for each Midwest division?

- b. What are the operating profits for each Midwest division using the differential cost basis for pricing transfers?

- c. Rank each division by

ROI using the transfer pricing methods in requirements (a) and (b). What difference does the transfer pricing system have on the rankings?

Trending nowThis is a popular solution!

Chapter 15 Solutions

Fundamentals Of Cost Accounting (6th Edition)

- For 20Y2, Tri-Comic Company initiated a sales promotion campaign that included the expenditure of an additional $50,000 for advertising. At the end of the year, Willie Green, the president, is presented with the following condensed comparative income statement: Tri-Comic Company Comparative Income Statement For the Years Ended December 31, 20Y2 and 20Y1 Sales Cost of goods sold Gross profit Selling expenses Administrative expenses Total operating expenses Income from operations Other revenue Income before income tax Income tax expense Net income Required: 2012 $1,500,000 510,000 $990,000 $270,000 180,000 $450,000 $540,000 60,000 $600,000 450,000 $150,000 20Y1 $1,250,000 475,000 $775,000 $200,000 156,250 $356,250 $418,750 50,000 $468,750 375,000 $93,750 Required: Prepare a comparative income statement for the two-year period, presenting an analysis of each item in relationship to sales for each of the years. Round to one decimal place. Enter all amounts as positive numbers.arrow_forwardPandora Corporation operates several factories in the Midwest that manufacture consumer electronics. The December 31, 2021, year-end trial balance contained the following income statement items: Account Title Debits CreditsSales revenue $ 12,500,000Interest revenue 50,000Loss on sale of investments $ 100,000Cost of goods sold 6,200,000Selling expense 620,000General and administrative expense 1,520,000Interest expense 40,000Research and development expense 1,200,000Income tax expense 900,000 Required:Calculate…arrow_forwardEcru Company has identified five industry segments: plastics, metals, lumber, paper, and finance. It appropriately consolidated each of these segments in producing its annual financial statements. Information describing each segment (in thousands) follows: (see screen shot) Ecru does not allocate its $1,480,000 in common expenses to the various segments. Perform testing procedures to determine Ecru’s reportable operating segments. Revenue test: Profit or loss test: Asset test:arrow_forward

- Solomon Corporation operates three investment centers. The following financial statements apply to the investment center named Bowman Division. BOWMAN DIVISION Income Statement For the Year Ended December 31, Year 2 Sales revenue $ 107,280 Cost of goods sold 58,875 Gross margin 48,405 Operating expenses Selling expenses (2,680 ) Depreciation expense (4,135 ) Operating income 41,590 Nonoperating item Loss on sale of land (4,000 ) Net income $ 37,590 BOWMAN DIVISION Balance Sheet As of December 31, Year 2 Assets Cash $ 12,532 Accounts receivable 40,316 Merchandise inventory 36,900 Equipment less accumulated depreciation 90,288 Nonoperating assets 9,600 Total assets $ 189,636 Liabilities Accounts payable $ 9,447 Notes payable 67,000 Stockholders’ equity Common stock 70,000 Retained earnings 43,189 Total liabilities and stockholder's…arrow_forwardAn entity was offering premium as a sales promotion scheme and that during the year it purchased 10,000 premiums for P20 each. Customers need to remit 10 boxes and P5 to redeem one premium. Assume there were no redemptions during the first year of the promotion, which of the following statements would be correct if it uses the revenue approach? a. The entity will report an inventory of premiums at the net cost of P15. Tb. he entity will report an estimated liability equal to the premium expense. c. None of the other choices are correct. Td. he entity will not report any expense since there were no redemption. e. No accounting liability shall be recognized since there were no redemptions.arrow_forwardDeere & Company manufactures and distributes farm and construction machinery that it sells around the world. In addition to its manufacturing operations, Deere’s credit division loans money to customers to finance the purchase of their farm and construction equipment.The following information is available for three recent years (in millions except pershare amounts): Please see the attachment for details: 1. Calculate the following ratios for each year, rounding ratios and percentages to one decimal place, except for per-share amounts:a. Return on total assetsb. Return on stockholders’ equityc. Earnings per shared. Dividend yielde. Price-earnings ratio2. Based on these data, evaluate Deere’s profitability.arrow_forward

- Pandora Corporation operates several factories in the Midwest that manufacture consumer electronics. TheDecember 31, 2018, year-end trial balance contained the following income statement items:Account Title Debits CreditsSales revenue 12,500,000Interest revenue 50,000Loss on sale of investments 100,000Cost of goods sold 6,200,000Selling expenses 620,000General and administrative expenses 1,520,000Interest expense 40,000Research and development expense 1,200,000Income tax expense 900,000Required:Calculate the company’s operating income for the yeararrow_forwardMarkle's Inc. had the following transactions during the year: total sales = $610,000; sales discounts = $13,000; sales returns = $36,000; sales allowances = $16,000. In addition, at the end of the year the company estimates the following transactions associated with sales in the current year will occur next year: sales discounts = $1,300; sales returns = $4,320; sales allowances = $2,130. Compute net sales. Total sales Net salesarrow_forwardScott Healthcare provides a walk-in clinic for its patients and a pharmacy for any medication prescribed by the doctor. Last year, Scott generated total sales of $500,000 and $100,000 in profits.Scott also had average assets of $250,000 for the year. What are Scott Healthcare’s return on sales(ROS), asset turnover (AT), and return on investment (ROI) for the year?arrow_forward

- Benson Company operates three segments. Income statements for the segments imply that profitability could be improved if Segment A were eliminated. Segment Sales Cost of goods sold Sales commissions BENSON COMPANY Income Statements for Year 2 Contribution margin General fixed operating expenses (allocation of president's salary) Advertising expense (specific to individual divisions) Net income (loss). Complete this question by entering your answers in the tabs below. Required A Required B A $ 169,000 (130,000) (21,000) 18,000 (43,000) (5,000) $ (30,000) B $ 238,000 (81,000) (23,000) 134,000 (37,000) (14,000) $ 83,000 с $ 247,000 (83,000) (31,000) 133,000 (26,000) 0 Required a. Prepare a schedule of relevant sales and costs for Segment A. b. Prepare comparative income statements for the company as a whole under two alternatives: (1) the retention of Segment A and (2) the elimination of Segment A. $ 107,000arrow_forwardPandora Corporation operates several factories in the Midwest that manufacture consumer electronics. The December 31, 2021, year- end trial balance contained the following income statement items: Account Title Sales revenue Debits Credits $13,100,000 56,000 Interest revenue Loss on sale of investments Cost of goods sold Selling expenses General and administrative expenses $ 106,000 6,260,000 626,000 1,580,000 46,000 1,260, e00 906, 000 Interest expense Research and development expense Income tax expense Required: Calculate the company's operating income for the year. Total operating revenue Less operating expenses Operating incomearrow_forwardD&G Textile company is evaluating two different operating structures. Data about those structures are shown below. Annual interest expense of the firm is $200, it has common shares outstanding of 2,000, and a tax rate of 20 percent.arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning