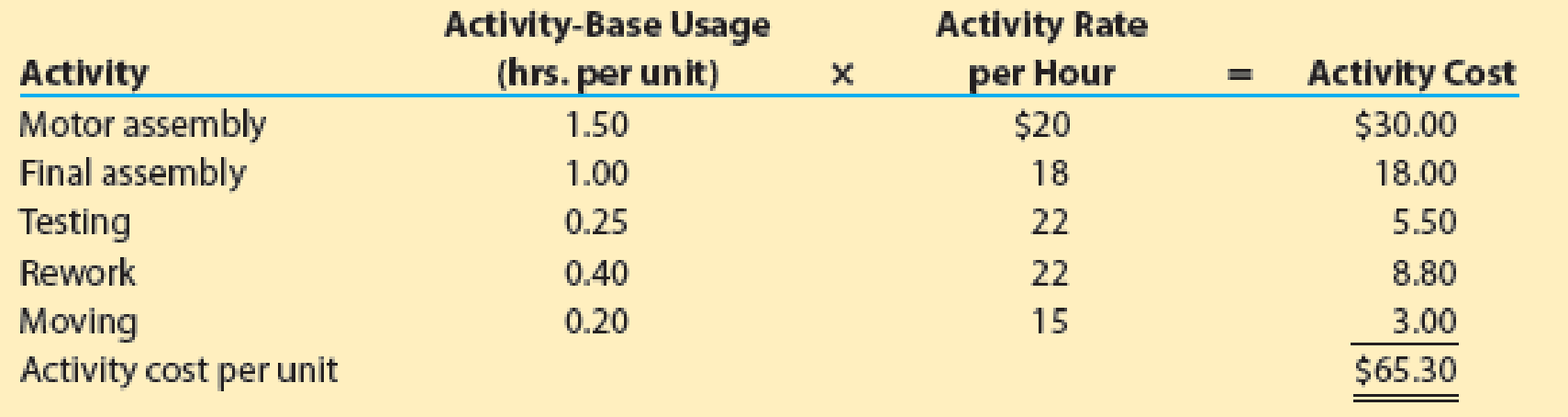

Life Force Fitness, Inc., assembles and sells treadmills. Activity-based product information for each treadmill is as follows:

All of the activity costs are related to labor. Management must remove $2.00 of activity cost from the product in order to remain competitive.

Rework involves disassembling and repairing a unit that fails testing. Not all units require rework, but the average is 0.40 hour per unit. Presently, the testing is done on the completed assembly; but much of the rework has been related to motors, which can be tested independently prior to adding the motor to the treadmill during final assembly. Thus, motor issues can be diagnosed and solved without having to disassemble the complete treadmill. This change will reduce the average rework per unit by one-quarter.

a. Determine the new activity cost per unit under the rework improvement scenario.

b. If management had the choice of doing the rework improvement in (a) or cutting the moving activity in half by improving the product flow, which decision should be implemented? Why?

Trending nowThis is a popular solution!

Chapter 18 Solutions

Financial And Managerial Accounting

- Splunge Manufacturing produces surfboards. The company uses a normal-costing system and allocates manufacturing overhead on the basis of direct manufacturing labor-hours. Most of the company's production and sales occur in the first and second quarters of the year. The company is in danger of losing one of its larger customers, Soho Wholesale, due to large fluctuations in price. The owner of Splunge has requested an analysis of the manufacturing cost per unit in the second and third quarters. You have been provided the following budgeted information for the coming year: E (Click the icon to view the budgeted information.) A (Click the icon to view additional information.) Read the requirements Requirement 1 and 2. Calculate the total manufacturing cost per unit for the second and third quarter assuming the company allocates manufacturing overhead costs based on the budgeted manufacturing overhead rate determined for each quarter and an annual budgeted manufacturing overhead rate. First…arrow_forwardWitt Recreation Company (WRC) makes e-bikes. The company currently manufactures two models, the Coaster and the Traveler, in one of the WRC factories. Both models require the same assembling operations. The difference between the models is the cost of materials. The following data are available for the second quarter. Number of bikes assembled Materials cost per bike Other costs: Direct labor Depreciation and lease Supervision and control Factory administration Material cost Operation cost Total cost Unit cost Coaster 770 $638 Coaster Required: Witt Recreation Company uses operations costing and assigns conversion costs based on the the direct materials costs. Compute the cost of each model assembled in the second quarter. Note: Do not round intermediate calculations. Round your answers to the nearest whole dollar amount. Traveler 470 $ 1,280 Traveler Total 1,240 $ $ $305,000 396,000 257,000 346,000 Total 0 0arrow_forwardReinhart Corporation makes bicycles. For many years, Reinhart has made the rear wheel assembly for its bicycles. Recently, Bennett Company offered to sell these rear wheel assemblies to Reinhart. If Reinhart makes the assembly, its cost per rear wheel assembly is as follows: Direct materials $10.00 Direct labor 18.00 Variable manufacturing overhead 10.00 Fixed manufacturing overhead, avoidable 8.00 Fixed manufacturing overhead, unavoidable (allocated on the basis of labor-hours) 10.00 Unit product cost $56.00 These…arrow_forward

- A company currently using an inspection process in its material receiving department is trying to install an overall cost reduction program. One possible reduction is the elimination of one inspection position. This position tests material that has defective content on an average of 0.04. By inspecting all items, the inspector is able to remove all defects. The inspector can inspect 50 units per hour. The hourly rate including fringe benefits for this position is $9. If the inspection position is eliminated, defects will go into the product assembly and will have to be replaced later at a cost of $10 each when they are detected in final product testing. (Answer in Appendix D)a. Should this inspection position be eliminated?b. What is the cost to inspect each unit?c. Is there a benefit (or loss) from the current inspection process? How much?arrow_forwardWitt Recreation Company (WRC) makes e-bikes. The company currently manufactures two models, the Coaster and the Traveler, in one of the WRC factories. Both models require the same assembling operations. The difference between the models is the cost of materials. The following data are available for the second quarter. Number of bikes assembled Materials cost per bike Other costs: Direct labor Depreciation and lease Supervision and control Factory administration Operation cost Materials cost Total cost Unit cost Coaster 750 $626 Coaster Traveler 450 $ 1,202 Required: Witt Recreation Company uses operations costing and assigns conversion costs based on the number of units assembled. Compute the cost of each model assembled in the second quarter. Note: Do not round intermediate calculations. Round your final answers to nearest whole number. Total 1,200 Traveler $ 299,400 382,400 247,400 340,400 Totalarrow_forwardRough N' Tough (RNT) manufactures outdoors accessories. Management is considering producing the poles for their tents rather than continuing to purchase from their current supplier. The supplier charges $60 per set of poles.The cost accounting team has estimated that RNT would incur the following costs if they were to produce the poles instead: $40 per set for direct materials, $10 per set for direct labor, $7 per set for variable overhead, and $20 per set for fixed overhead application.RNT currently has unused production capacity and manufacturing equipment that could be used to manufacture the poles. RNT has planned to sell 5,000 tents this year. What would the change in overall cost be for the company if RNT produced the poles rather than purchasing them?arrow_forward

- Erie Company manufactures a mobile fitness device called the Jogging Mate. The company uses standards to control its costs. The labor standards that have been set for one Jogging Mate are as follows: Standard Standard Rate per Hour $ 6.20 Standard Hours 24 minutes Cost $ 2.48 During August, 8,620 hours of direct labor time were needed to make 19,600 units of the Jogging Mate. The direct labor cost totaled $51,720 for the month. Required: 1. What is the standard labor-hours allowed (SH) to makes 19,600 Jogging Mates? 2 What is the standard labor cost allowed (SH x SR) to make 19,.600 Jogging Mates? 3. What is the labor spending variance? 4. What is the labor rate variance and the labor efficiency variance? 5. The budgeted variable manufacturing overhead rate is S4.10 per direct labor-hour. During August, the company incurred $41,376 in variable manufacturing overhead cost. Compute the variable overhead rate and efficiency variances for the month. (For requirements 3 through 5, indicate…arrow_forwardMcClellan Recreation manufactures and sells two models of paddle boards: Starter and Pro. The Starter model is a basic board used for instruction and purchased by novices. The Pro model is made with premium materials and comes with several accessories. The boards are produced to order, and there are no inventories at the end of the year. The cost accounting system at McClellan allocates overhead to products based on direct labor cost. Overhead in year 1, which just ended, was $2,536,800. Data on units sold for year 1 along with the unit sales price and unit direct costs for the two models follow: Sales price per unit Direct materials per unit Direct labor per unit Required: a. Compute product line profits or loss for the Starter model and the Pro model for year 1. b. A study of overhead shows that without the Starter model, overhead would fall to $1,442,000. Assume all other revenues and costs would remain the same for the Pro model in year 2. Compute product line profits for the Pro…arrow_forwardCarla Vista Innovations, Inc. produces exercise and fitness gear. Two of its newer products require a finishing process that can only be completed on machines that were recently purchased for this purpose. The machines have a maximum capacity of 10,500 machine hours, and no other products that the company makes use these machines. Sarah Jacob, the company's operations manager, is preparing the production schedule for the coming month and can't seem to find enough machine time to produce enough units to meet the customer demand that the marketing department has included in the sales budget. Michael Stoner, the company's controller, has gathered the following information about the two products: Dumbbell Weight Rack Bench Selling price per unit $44 $60 Direct materials 19 16 Direct labor 4 8 Variable overhead 3 6 Fixed overhead 5 10 Profit per unit $13 $20 Unit sales demand 5,000 8,000 Machine hours per unit 0.75 1.5 LOarrow_forward

- Carla Vista Innovations, Inc. produces exercise and fitness gear. Two of its newer products require a finishing process that can only be completed on machines that were recently purchased for this purpose. The machines have a maximum capacity of 10,500 machine hours, and no other products that the company makes use these machines. Sarah Jacob, the company's operations manager, is preparing the production schedule for the coming month and can't seem to find enough machine time to produce enough units to meet the customer demand that the marketing department has included in the sales budget. Michael Stoner, the company's controller, has gathered the following information about the two products: Dumbbell Weight Rack Bench Selling price per unit $44 $60 Direct materials 19 16 Direct labor 4 8 Variable overhead 3 6 Fixed overhead 10 Profit per unit $13 $20 Unit sales demand 5,000 8,000 Machine hours per unit 0.75 1.5arrow_forwardCooper Corporation makes bicycles. For many years, Cooper has made the rear wheel assembly for its bicycles. Recently, Rojas Company offered to sell these rear wheel assemblies to Cooper. If Cooper makes the assembly, its cost per rear wheel assembly is as follows: Direct materials $8.00 Direct labor 15.00 Variable manufacturing overhead 8.00 Fixed manufacturing overhead, avoidable 6.00 Fixed manufacturing overhead, unavoidable (allocated on the basis of labor-hours) 8.00 Unit product cost $45.00 These costs are based on an annual production of 40,000 units. Rojas offered to sell the assembly to Cooper for $32.00 each. The total order would amount to 40,000 rear wheel assemblies per year, which Cooper’s management will buy instead of making if the company can save at least $100,000 per year. Required: a) Should Cooper make rear wheel assemblies or buy them from Rojas? Show computations.arrow_forwardMarwick Innovations, Inc. produces exercise and fitness gear. Two of its newer products require a finishing process that can only be completed on machines that were recently purchased for this purpose. The machines have a maximum capacity of 10,500 machine hours, and no other products that the company makes use these machines.Sarah Jacob, the company’s operations manager, is preparing the production schedule for the coming month and can’t seem to find enough machine time to produce enough units to meet the customer demand that the marketing department has included in the sales budget.Michael Stoner, the company’s controller, has gathered the following information about the two products: DumbbellRack WeightBench Selling price per unit $50 $60 Direct materials 20 12 Direct labor 6 12 Variable overhead 3 6 Fixed overhead 5 10 Profit per unit $16 $20 Unit sales demand 5,000…arrow_forward

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub