Financial And Managerial Accounting

15th Edition

ISBN: 9781337902663

Author: WARREN, Carl S.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 18, Problem 3MAD

Labor classification trade-off

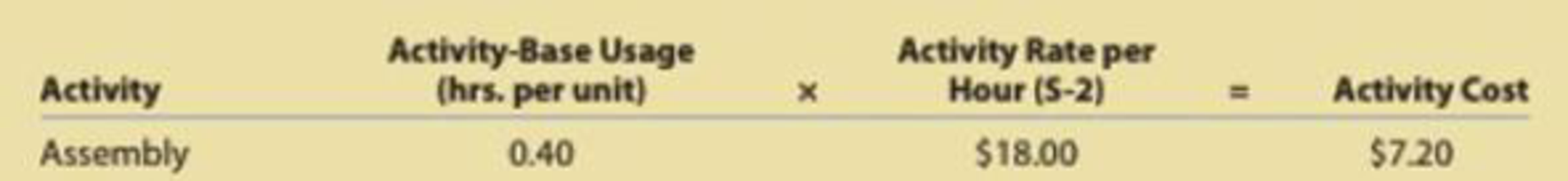

Skidmore Electronics manufactures consumer electronic products. The company has three assembly labor classifications, S-1, S-2, and S-3. The three classifications are paid $15, $18, and $22 per hour, respectively. The assembly activity for a new smartphone is as follows:

A product engineer proposes using a higher-rated employee to perform the assembly on the new phone. His analysis has shown that an S-3 employee can perform the assembly in 0.35 hour per unit.

- A. Determine the Assembly activity cost using the S-3 labor classification.

- B. Is the product engineer’s proposal supported?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Assigning Costs to Activities

McCourt Company produces small engines for lawnmower producers. The accounts payable department at McCourt has 10 clerks who process and pay supplier invoices. The total cost of their salaries is $550,000. The work distribution for the activities that they perform is as follows:

Activity

Percentage of Time on Each Activity

Comparing source documents

10 %

Resolving discrepancies

45 %

Processing payment

45 %

Required:

Assign the cost of labor to each of the three activities in the accounts payable department. Round your answers to the nearest dollar.

Activity

Cost Assignment

Comparing source documents

$

Resolving discrepancies

$

Processing payment

$

Make-or-Buy, Traditional and ABC Analysis

Brees, Inc., a manufacturer of golf carts, has just received an offer from a supplier to provide 2,600 units of a component used in its main product. The component is a track assembly that is currently produced internally. The supplier has offered to sell the track assembly for $67 per unit. Brees is currently using a traditional, unit-based costing system that assigns overhead to jobs on the basis of direct labor hours. The estimated traditional full cost of producing the track assembly is as follows:

Direct materials

$40.00

Direct labor

18.00

Variable overhead

4.00

Fixed overhead

40.00

Prior to making a decision, the company’s CEO commissioned a special study to see whether there would be any decrease in the fixed overhead costs. The results of the study revealed the following:

3 setups—$1,180 each (The setups would be avoided, and total spending could be reduced by $1,180 per setup.)

One half-time inspector is needed. The company…

Angle Max Industries produces a product which goes through two operations, Assembly and Finishing,

before it is ready to be shipped. Next year's expected costs and activities are shown below.

Direct labor hours

Machine hours

Overhead costs

Multiple Choice

Assume that the Assembly Department allocates overhead using a plantwide overhead rate based on machine hours.

How much total overhead will be assigned to a product that requires 2 direct labor hour and 3.30 machine hours in the

Assembly Department, and 4.50 direct labor hours and 0.4 machine hours in the Finishing Department?

O$17.60.

Assembly

180,000 DLH

380,000 MH

$380,000

$20.40.

Finishing

148,000 DLH

91, 200 MH

$562, 400

Chapter 18 Solutions

Financial And Managerial Accounting

Ch. 18 - Why would management be concerned about the...Ch. 18 - Why would a manufacturing company with multiple...Ch. 18 - How do the multiple production department and the...Ch. 18 - Under what two conditions would the multiple...Ch. 18 - How does activity-based costing differ from the...Ch. 18 - Shipping, selling, marketing, sales order...Ch. 18 - Prob. 7DQCh. 18 - Under what circumstances might the activity-based...Ch. 18 - When might activity-based costing be preferred...Ch. 18 - Prob. 10DQ

Ch. 18 - Single plantwide factory overhead rate The total...Ch. 18 - Multiple production department factory overhead...Ch. 18 - Activity-based costing: factory overhead costs The...Ch. 18 - Activity-based costing: selling and administrative...Ch. 18 - Activity-based costing for a service business...Ch. 18 - Kennedy Appliance Inc.s Machining Department...Ch. 18 - Bach Instruments Inc. makes three musical...Ch. 18 - Scrumptious Snacks Inc. manufactures three types...Ch. 18 - Isaac Engines Inc. produces three productspistons,...Ch. 18 - Handy Leather, Inc., produces three sizes of...Ch. 18 - Eclipse Motor Company manufactures two types of...Ch. 18 - The management of Nova Industries Inc....Ch. 18 - Comfort Foods Inc. uses activity-based costing to...Ch. 18 - Nozama.com Inc. sells consumer electronics over...Ch. 18 - Hercules Inc. manufactures elliptical exercise...Ch. 18 - Lonsdale Inc. manufactures entry and dining room...Ch. 18 - Activity cost pools, activity rates, and product...Ch. 18 - Handbrain Inc. is considering a change to...Ch. 18 - Prob. 14ECh. 18 - Activity-based costing and product cost distortion...Ch. 18 - Single plantwide rate and activity-based costing...Ch. 18 - Evaluating selling and administrative cost...Ch. 18 - Construct and interpret a product profitability...Ch. 18 - Metroid Electric manufactures power distribution...Ch. 18 - Activity-based costing for a service company...Ch. 18 - Bounce Back Insurance Company carries three major...Ch. 18 - Gwinnett County Chrome Company manufactures three...Ch. 18 - The management of Gwinnett County Chrome Company,...Ch. 18 - Activity-based and department rate product costing...Ch. 18 - Activity-based product costing Mello Manufacturing...Ch. 18 - Allocating selling and administrative expenses...Ch. 18 - Product costing and decision analysis for a...Ch. 18 - Single plantwide factory overhead rate Spotted Cow...Ch. 18 - Multiple production department factory overhead...Ch. 18 - Activity-based department rate product costing and...Ch. 18 - Activity-based product costing Sweet Sugar Company...Ch. 18 - Allocating selling and administrative expenses...Ch. 18 - Product costing and decision analysis for a...Ch. 18 - Life Force Fitness, Inc., assembles and sells...Ch. 18 - Activity-based product cost improvement Gourmet...Ch. 18 - Labor classification trade-off Skidmore...Ch. 18 - Production run size and activity improvement...Ch. 18 - Hospital activity-based costing analysis Lancaster...Ch. 18 - Ethics in Action The controller of Tri Con Global...Ch. 18 - Communication The controller of New Wave Sounds...Ch. 18 - Pelder Products Company manufactures two types of...Ch. 18 - The Chocolate Baker specializes in chocolate baked...Ch. 18 - Young Company is beginning operations and is...Ch. 18 - Cynthia Rogers, the cost accountant for Sanford...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Vargas, Inc., produces industrial machinery. Vargas has a machining department and a group of direct laborers called machinists. Each machinist is paid 25,000 and can machine up to 500 units per year. Vargas also hires supervisors to develop machine specification plans and to oversee production within the machining department. Given the planning and supervisory work, a supervisor can oversee three machinists, at most. Vargass accounting and production history reveal the following relationships between units produced and the costs of direct labor and supervision (measured on an annual basis): Required: 1. Prepare two graphs: one that illustrates the relationship between direct labor cost and units produced, and one that illustrates the relationship between the cost of supervision and units produced. Let cost be the vertical axis and units produced the horizontal axis. 2. How would you classify each cost? Why? 3. Suppose that the normal range of activity is between 2,400 and 2,450 units and that the exact number of machinists is currently hired to support this level of activity. Further suppose that production for the next year is expected to increase by an additional 400 units. How much will the cost of direct labor increase (and how will this increase be realized)? Cost of supervision?arrow_forwardDurban Metal Products makes specialty metal parts and uses activity-based costing for internal decision-making purposes. The company has four activity cost pools as follows: Activity Cost Pool Order size Customer orders Product testing Selling Activity Measure Number of direct labor-hours Number of customer orders Number of testing hours Number of sales calls The company's owner wants to know the cost of a customer order requiring 200 direct labor-hours, 11 hours of product testing, and 5 sales calls. Required: What is the total overhead cost assigned to this order? Activity Cost Pool Order size Customer orders Product testing Selling Total overhead cost Activity Rate $ 17.90 per direct labor-hour $ 351.00 per customer order $ 77.00 per testing hour $ 1,496.00 per sales call ABC Costarrow_forwardDurban Metal Products, Limited, of the Republic of South Africa makes specialty metal parts used in applications ranging from the cutting edges of bulldozer blades to replacement parts for Land Rovers. The company uses an activity-based costing system for internal decision-making purposes. The company has four activity cost pools as listed below: Activity Cost Pool Order size Customer orders. Product testing Selling Activity Measure Number of direct labor-hours Number of customer orders Number of testing hours Number of sales calls Activity Rate $ 18.00 per direct labor-hour $ 357.00 per customer order $ 82.00 per testing hour $ 1,483.00 per sales call The managing director of the company would like information concerning the cost of a recently completed order for heavy-duty trailer axles. The order required 200 direct labor-hours, 13 hours of product testing, and 5 sales calls. Required: What is the total overhead cost assigned to the order for heavy-duty trailer axles? Activity Cost…arrow_forward

- Ole Company manufactures two products, Product A and Product B. Currently, machine hours are used to allocate the overhead costs to the two products. Ole Company is considering adopting an activity-based costing system. If so, overhead costs will be traced to the following activities: Activities Machining Quality Control Material Moves Activity cost pools $300,000 $200,000 $400,000 Cost Drivers Machine Hours Number of inspections Number of moves Product A 30,000 400 2,000 Product B 20,000 600 6,000 (a) Calculate the total overhead cost assigned to Product A under the current system. (b) Calculate the total overhead cost for Product A if the company implements activity-based costing system. (c) Briefly explain which costing method gives a more accurate picture of the costs. (d) Suppose you are the management accountant in a university. List any three (3)activities commonly carried out in universities and identify an appropriate cost driver for each activity.arrow_forwardWoolCorp WoolCorp buys sheep’s wool from farmers. The company began operations in January of this year, and is making decisions on product offerings, pricing, and vendors. The company is also examining its method of assigning overhead to products. You’ve just been hired as a production manager at WoolCorp. Currently WoolCorp makes three products: (1) raw, clean wool to be used as stuffing or insulation; (2) wool yarn for use in the textile industry, and (3) extra-thick yarn for use in rugs. Upper management would like your recommendations regarding a production decision regarding their current and proposed product lines. Continue/Discontinue For the past year, WoolCorp has experimented with its third product, extra-thick rug yarn. The company wishes to consider whether to continue or discontinue manufacturing and selling this product. You decide to prepare a differential analysis of the income related to all three products. To begin your analysis, you review the following condensed…arrow_forwardDynaMore is a video console manufacturer. Information about the company’s two products follows: [picture 1] The company incurs $885,800 in overhead per year and has traditionally applied overhead on the basis of direct labor hours. Each unit of product requires one testing. Required How much overhead will be allocated to each product using the traditional direct labor hours allocation base? What overhead cost per unit will be allocated to each product? Assume that DynaMore has identified three activity cost pools. [picture 2] Given these activity pools and cost drivers, determine the activity rates. How much overhead should be allocated to each TD-1000 under activity-based costing? Explain the difference in overhead costs per console under traditional costing and activity-based costing.arrow_forward

- WoolCorp WoolCorp buys sheep’s wool from farmers. The company began operations in January of this year, and is making decisions on product offerings, pricing, and vendors. The company is also examining its method of assigning overhead to products. You’ve just been hired as a production manager at WoolCorp. Currently WoolCorp makes two products: (1) raw, clean wool to be used as stuffing or insulation and (2) wool yarn for use in the textile industry. The company would like you to evaluate its costing methods for its raw wool and wool yarn. Single Plantwide Rate WoolCorp is currently using the single plantwide factory overhead rate method, which uses a predetermined overhead rate based on an estimated allocation base such as direct labor hours or machine hours. The rate is computed as follows: Single Plantwide Factory Overhead Rate = (Total Budgeted Factory Overhead) ÷ (Total Budgeted Plantwide Allocation Base) WoolCorp has been using combing machine hours as its allocation base.…arrow_forwardComputing product costs in an ABC system The Alright Manufacturing Company in Rochester, Minnesota, assembles and tests electronic components used in smartphones. Consider the following data regarding component T24 (amounts are per unit): Requirements Complete the missing items for the two tables. Why might managers favor this ABC system instead of Alright’s older system, which allocated all manufacturing overhead costs on the basis of direct labor hours?arrow_forwardGoodwill LLC manufacturing two products, A and B. The company currently adopts traditional method of charging overheads to the products based on labour hours. The company now wishes to adopt the Activity Based Costing method of allocating overheads, to do its product costing accurately. The company furnishes the following data for a year: Product A Product B Direct material @ RO 5 per Kg 6 Kgs 5 Kgs Direct Labour @ RO 10 per hour 4.5 hours 5 hours Product Annual Output (units) Total machine hours Total number of purchase orders Total number of set ups A 100 500 50 5 B 75 700 40 10 The annual overheads are as under: Volume related activity costs RO 20,000 Set up related costs RO 15,000 Purchase related costs RO 35,000 Total RO 70,000 Based on the above information,…arrow_forward

- Required information [The following information applies to the questions displayed below.] Performance Products Corporation makes two products, titanium Rims and Posts. Data regarding the two products follow: Rims Posts: Direct Labor- Hours per unit 0.40 0.60 Additional information about the company follows: a. Rims require $20 in direct materials per unit, and Posts require $18. b. The direct labor wage rate is $18 per hour. c. Rims are more complex to manufacture than Posts and they require special equipment. d. The ABC system has the following activity cost pools: Activity Cost Pool Machine setups Special processing General factory Annual Production 26,000 units 88,000 units Unit product cost of Rims Unit product cost of Posts Activity Measure Number of setups Machine-hours Direct labor-hours. Estimated Overhead Cost $28,160 $ 164,560 $ 780,000 Estimated Activity Rims 110 2,000 10,400 Posts 90 0 52,800 Total 200 2,000 63,200 2. Determine the unit product cost of each product…arrow_forwardSIMPly Power Inc., manufactures and sells two products: Product V9 and Product B1. Data concerning the expected production of each product and the expected total direct labour-hours (DLHS) required to produce that output appear below: Product V9 Product B1 Total direct labour-hours Product V9 Product B1 Activity Cost Pools Labour-related The direct labour rate is $27.40 per DLH. The direct materials cost per unit for each product is given below: Machine setups General factory Expected Production 300 The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity: O $86.5 per unit 800 O $129.12 per unit O $217.95 per unit O $272.08 per unit Activity Measures DLHS Direct Labour-Hours Per Unit 5.0 3.0 setups Direct Materials Cost per Unit $176.90 $262.80 MHS Estimated Overhead Cost $94,848 36,990 62,408 $194,246 Total Direct Labour- Hours 1,500 2,400 3.900 Expected Activity Product V9 Product B1 Total…arrow_forwardDurban Metal Products, Ltd., of the Republic of South Africa makes specialty metal parts used in applications ranging from the cutting edges of bulldozer blades to replacement parts for Land Rovers. The company uses an activity-based costing system for internal decision-making purposes. The company has four activity cost pools as listed below: Activity Cost Pool Activity Measure Activity Rate Order size Number of direct labor-hours $ 16.85 per direct labor-hour Customer orders Number of customer orders $ 320.00 per customer order Product testing Number of testing hours $ 89.00 per testing hour Selling Number of sales calls $ 1,090.00 per sales call The managing director of the company would like information concerning the cost of a recently completed order for heavy-duty trailer axles. The order required 200 direct labor-hours, 4 hours of product testing, and 2 sales calls. Required: What is the total overhead cost assigned to the order for heavy-duty trailer…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

What is variance analysis?; Author: Corporate finance institute;https://www.youtube.com/watch?v=SMTa1lZu7Qw;License: Standard YouTube License, CC-BY