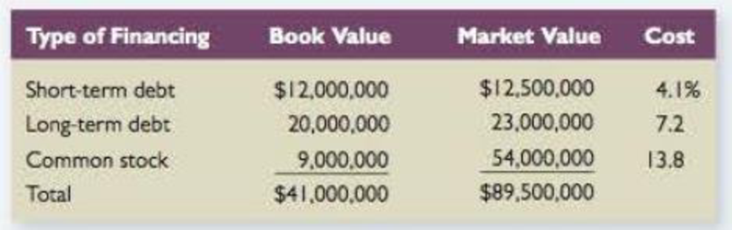

WACC Bolero, Inc., has compiled the following information on its financing costs:

The company is in the 35 percent tax bracket and has a target debt-equity ratio of 60 percent. The target short-term debt/long-term debt ratio is 20 percent.

- a. What is the company’s weighted average cost of capital using book value weights?

- b. What is the company’s weighted average cost of capital using market value weights?

- c. What is the company's weighted average cost of capital using target capital structure weights?

- d. What is the difference between WACCs? Which is the correct WACC to use for project evaluation?

a.

To determine: The Company’s Weighted Average Cost of Capital using Book Value Weights.

Introduction: Beta is the risk related with a portfolio or a security in connection to the market. It is also termed as the beta coefficient; it is a method for deciding on the requirement on security or stock that may move in contrast with the market. Leverage is a method that increases profits or losses of the shareholders. It is usually used to illustrate the utilization of funds borrowed to increase income prospective or financial leverage. However it can also explain the use of fixed assets to accomplish the similar objectives.

Answer to Problem 9QP

The Company’s Weighted Average Cost of Capital using Book Value Weights is 6.09%.

Explanation of Solution

Determine the Weight of Short-Term Debt

Therefore the Weight of Short-Term Debt is 0.2927

Determine the Weight of Long-Term Debt

Therefore the Weight of Long-Term Debt is 0.4878

Determine the Weight of Equity

Therefore the Weight of Equity is 0.2195

Determine the Weighted Average Cost of Capital using Book Value Weights

Therefore the Weighted Average Cost of Capital using Book Value Weights is 6.09%

b.

To determine: The Company’s Weighted Average Cost of Capital using Market Value Weights.

Answer to Problem 9QP

The Company’s Weighted Average Cost of Capital using Market Value Weights is 9.90%.

Explanation of Solution

Determine the Weight of Short-Term Debt

Therefore the Weight of Short-Term Debt is 0.1397

Determine the Weight of Long-Term Debt

Therefore the Weight of Long-Term Debt is 0.2570

Determine the Weight of Equity

Therefore the Weight of Equity is 0.6034

Determine the Weighted Average Cost of Capital using Market Value Weights

Therefore the Weighted Average Cost of Capital using Market Value Weights is 9.90%

c.

To determine: The Company’s Weighted Average Cost of Capital using Target Capital Structure Weights.

Answer to Problem 9QP

The Company’s Weighted Average Cost of Capital using Target Capital Structure Weights is 10.25%.

Explanation of Solution

Determine the Value of Debt

Therefore the Value of Debt is 37.5%

Determine the Value of Equity

Therefore the Value of Equity is 62.5%

Determine the Weight of Short-Term Debt of Total Debt

Therefore the Weight of Short-Term Debt of Total Debt is 0.1667

Determine the Weight of Long-Term Debt of Total Debt

Therefore the Weight of Long -Term Debt of Total Debt is 0.8333

Determine the Weight of Short-Term Debt

Therefore the Weight of Short-Term Debt is 6.25%

Determine the Weight of Long-Term Debt

Therefore the Weight of Long-Term Debt is 31.25%

Determine the Weighted Average Cost of Capital using Target Capital Structure Weights:

Therefore the Weighted Average Cost of Capital using Target Capital Structure Weights is 10.25%

d.

To determine: The Difference between WACC and the appropriate WACC to use for project evaluation.

Explanation of Solution

The difference between WACC and the appropriate WACC to use for project evaluation is as follows:

The difference in WACC between the three weights is based on the diverse weights. The WACC of the company is equally look like the WACC estimated by using target weights as the project will be financed under the target ratio. Hence, the WACC calculated using target weights should be considered for project evaluation.

Want to see more full solutions like this?

Chapter 18 Solutions

Corporate Finance (The Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

- Give typing answer with explanation and conclusion Fama's Llamas has a weighted average cost of capital of 11.5 per cent. The company's cost of equity is 16 per cent, and its cost of debt is 8.5 per cent. The tax rate is 35 per cent. What is Fama's debt–equity ratio?arrow_forwardPhil's Carvings Inc wants to have a weighted average cost of capital of 9.8 percent. The firm has an after- tax cost of debt of 6.6 percent and a cost of equity of 13.2 percent. What debt-equity ratio is needed for the firm to achieve their targeted weighted average cost of capital?arrow_forwardPetra plc. has a current and target leverage ratio of 0.8, the finance cost from loans is 16 per cent, and a cost of equity of 20 per cent. The corporation tax rate is 35 per cent. What is the weighted cost of capitalarrow_forward

- K. Bell Jewelers wishes to explore the effect on its cost of capital of the rate at which the company pays taxes. The firm wishes to maintain a capital structure of 30% debt, 20% preferred stock, and 50% common stock. The cost of financing with retained earnings is 13%, the cost of preferred stock financing is 8%, and the before-tax cost of debt financing is 6%. Calculate the weighted average cost of capital (WACC) given a tax rate ofarrow_forwardCalculation of individual costs and WACC Dillon Labs has asked its financial manager to measure the cost of each specific type of capital as well as the weighted average cost of capital. The weighted average cost is to be measured by using the following weights: 30% long-term debt, 15% preferred stock, and 55% common stock equity (retained earnings, new common stock, or both). The firm's tax rate is 22%. Debt The firm can sell for $1015 a 10-year, $1,000-par-value bond paying annual interest at a 8.00% coupon rate. A flotation cost of 2% of the par value is required. Preferred stock 8.50% (annual dividend) preferred stock having a par value of $100 can be sold for $96. An additional fee of $4 per share must be paid to the underwriters. Common stock The firm's common stock is currently selling for $60 per share. The stock has paid a dividend that has gradually increased for many years, rising from $2.70 ten years ago to the $5.07 dividend payment,…arrow_forwardCalculation of individual costs and WACC Dillon Labs has asked its financial manager to measure the cost of each specific type of capital as well as the weighted average cost of capital. The weighted average cost is to be measured by using the following weights: 30% long-term debt, 15% preferred stock, and 55% common stock equity (retained earnings, new common stock, or both). The firm's tax rate is 22%. Debt The firm can sell for $1025 a 18-year, $1,000-par-value bond paying annual interest at a 8.00% coupon rate. A flotation cost of 4% of the par value is required. Preferred stock 10.00% (annual dividend) preferred stock having a par value of $100 can be sold for $92. An additional fee of $2 per share must be paid to the underwriters. Common stock The firm's common stock is currently selling for $59.43 per share. The stock has paid a dividend that has gradually increased for many years, rising from $2.00 ten years ago to the $3.26 dividend payment, Do, that the company just recently…arrow_forward

- Calculation of individual costs and WACC Dillon Labs has asked its financial manager to measure the cost of each specific type of capital as well as the weighted average cost of capital. The weighted average cost is to be measured by using the following weights: 50% long-term debt, 15% preferred stock, and 35% common stock equity (retained earnings, new common stock, or both). The firm's tax rate is 29%. Debt The firm can sell for $1015 a 20-year, $1,000-par-value bond paying annual interest at a 6.00% coupon rate. A flotation cost of 2% of the par value is required. Preferred stock 9.50% (annual dividend) preferred stock having a par value of $100 can be sold for $98. An additional fee of $2 per share must be paid to the underwriters. Common stock The firm's common stock is currently selling for $90 per share. The stock has paid a dividend that has gradually increased for many years, rising from $3.00 ten years ago to the $5.63 dividend payment,…arrow_forwardPhil's Carvings, Inc. wants to have a weighted average cost of capital of 9%. The firm has an after-tax cost of debt of 5% and a cost of equity of 11%. What debt-equity ratio is needed for the firm to achieve its targeted weighted average cost of capital?arrow_forwardCalculation of individual costs and WACC Dillon Labs has asked its financial manager to measure the cost of each specific type of capital as well as the weighted average cost of capital. The weighted average cost is to be measured by using the following weights: 35% long-term debt,15% preferred stock, and 50%common stock equity (retained earnings, new common stock, or both). The firm's tax rate is 29%. Debt The firm can sell for $1000 a 15-year, $1,000-par-value bond paying annual interest at a 11.00%coupon rate. A flotation cost of 2.5% of the par value is required. Preferred stock 8.50% (annual dividend) preferred stock having a par value of $100 can be sold for $98.An additional fee of $3 per share must be paid to the underwriters. Common stock The firm's common stock is currently selling for $90 per share. The stock has paid a dividend that has gradually increased for many years, rising from $2.70 ten years ago to the $4.84 dividend payment,…arrow_forward

- The calculation of WACC involves calculating the weighted average of the required rates of return on debt and equity, where the weights equal the percentage of each type of financing in the firm's overall capital structure. re . has $3.9 million of debt, $1 million of preferred stock, and $1.2 million of common equity. What would be its weight on preferred stock? Ip Is is the symbol that represents the before-tax cost of debt in the weighted average cost of capital (WACC) equation. rd 0.13 0.64 0.16 0.14arrow_forwardHere is the problem: Famas's LLamas has a weighted average cost of capital of 7.9%. The company's cost of equity is 11% and its pretaxt cost of debt is 5.8%. The taxt rate is 25%. What is the company's target debt-equity ratio? Here is the solution: Here we have the WACC and need to find the debt-equity ratio of the company. Setting up the WACC equation, we find: WACC = .0790 = .11(E/V) + .058(D/V)(1 – .25) Rearranging the equation, we find: .0790(V/E) = .11 + .058(.75)(D/E) Now we must realize that the V/E is just the equity multiplier, which is equal to: V/E = 1 + D/E .0790(D/E + 1) = .11 + .0435(D/E) Now we can solve for D/E as: .0355(D/E) = .031 D/E = .8732 Question: I need help especifically with the part where they rearrange the equation as: .0790(V/E) = .11 + .058(.75)(D/E). How do they get an inverse (V/E) on the left side without the .11. And how do they get a (D/E) ratio. I understand…arrow_forwardCalculation of individual costs and WACC Dillon Labs has asked its financial manager to measure the cost of each specific type of capital as well as the weighted average cost of capital. The weighted average cost is to be measured by using the following weights: 40% long-term debt, 15% preferred stock, and 45% common stock equity (retained earnings, new common stock, or both). The firm's tax rate is 23%. Debt The firm can sell for $1010 a 14-year, $1,000-par-value bond paying annual interest at a 8.00% coupon rate. A flotation cost of 3.5% of the par value is required. Preferred stock 7.00% (annual dividend) preferred stock having a par value of $100 can be sold for $98. An additional fee of $4 per share must be paid to the underwriters. Common stock The firm's common stock is currently selling for $80 per share. The stock has paid a dividend that has gradually increased for many years, rising from $2.50 ten years ago to the $4.92 dividend payment, D, that the company just recently…arrow_forward

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT