Financial & Managerial Accounting

14th Edition

ISBN: 9781337119207

Author: Carl Warren, James M. Reeve, Jonathan Duchac

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 20, Problem 3ADM

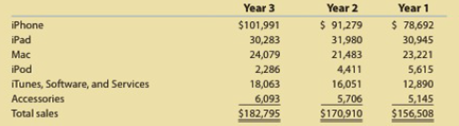

Apple Inc.: Segment revenue analysis

Segment disclosure by Apple Inc. provides sales information for its major product lines for three recent years as follows (in millions):

- A. Which product had the greatest percentage of Year 3 sales? Which product had the least percentage of Year 3 sales? (Round to nearest whole percent.)

- B. Which product grew the most in sales, in percentage terms, using Year 1 as the base year? (Round to nearest whole percent.)

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Adams Company reported the following operating results for two consecutive years:

Required

Compute each income statement component for each of the two years as a percent of sales.

Note: Percentages may not add exactly due to rounding. Round your answers to 1 decimal place. (i.e., .234 should be entered as

23.4).

Sales

Cost of goods sold

Gross margin on sales

Operating expenses

Income before taxes

Income taxes

Net income

ADAMS COMPANY

Vertical Analysis of Income Statements

Year 4

Percentage of

Sales for Year 4

100.0

%

$

$

X Answer is not complete.

999,500

549,725

449,775

129,400

320,375

81,000

239,375

%

$

$

Year 3

1,081,500

598,400

483,100

152,000

331,100

80,400

250,700

Percentage of

Sales for Year 3

100.0 %

%

1. Prepare a comparative income statement for the two-year period, presenting an analysis of each item in relationship to sales for each of the years. Round to one decimal place. Enter all amounts as positive numbers.

Fielder Industries Inc.

Comparative Income Statement

For the Years Ended December 31, 20Y2 and 20Y1

20Y2 Amount

20Y2 Percent

20Y1 Amount

20Y1 Percent

Sales

$1,300,000

fill in the blank bcf5f3fbd02f054_1%

$1,180,000

fill in the blank bcf5f3fbd02f054_2%

Cost of goods sold

682,500

fill in the blank bcf5f3fbd02f054_3%

613,600

fill in the blank bcf5f3fbd02f054_4%

Gross profit

$617,500

fill in the blank bcf5f3fbd02f054_5%

$566,400

fill in the blank bcf5f3fbd02f054_6%

Selling expenses

$260,000

fill in the blank bcf5f3fbd02f054_7%

$188,800

fill in the blank bcf5f3fbd02f054_8%

Administrative expenses

169,000

fill in the blank bcf5f3fbd02f054_9%

177,000

fill in the blank bcf5f3fbd02f054_10%

Total operating expenses

$429,000

fill in the blank…

Assume the following sales data for a company:Current year$832,402 Preceding year608,082What is the percentage increase in sales from the preceding year to the current year?

a.136.89%

b.36.89%

c.73.05%

d.26.95%

The relationship of $242,729 to $104,267, expressed as a ratio, is

a.0.8

b.2.3

c.0.4

d.0.7

Chapter 20 Solutions

Financial & Managerial Accounting

Ch. 20 - What types of costs are customarily included in...Ch. 20 - Which type of manufacturing cost (direct...Ch. 20 - Which of the following costs would be included in...Ch. 20 - In the variable costing income statement, how are...Ch. 20 - Since all costs of operating a business are...Ch. 20 - Discuss how financial data prepared on the basis...Ch. 20 - Why might management analyze product...Ch. 20 - Explain why rewarding sales personnel on the basis...Ch. 20 - Discuss the two factors affecting both sales and...Ch. 20 - How is the quantity factor for an increase or a...

Ch. 20 - Explain why service companies use different...Ch. 20 - Variable costing Marley Company has the following...Ch. 20 - Variable costingproduction exceeds sales Fixed...Ch. 20 - Variable costing sales exceed production The...Ch. 20 - Analyzing income under absorption and variable...Ch. 20 - Contribution margin by segment The following...Ch. 20 - Contribution margin analysis The actual variable...Ch. 20 - Inventory valuation under absorption costing and...Ch. 20 - Income statements under absorption costing and...Ch. 20 - Income statements under absorption costing and...Ch. 20 - Cost of goods manufactured, using variable costing...Ch. 20 - Variable costing income statement On November 30,...Ch. 20 - Absorption costing income statement On March 31....Ch. 20 - Variable costing income statement The following...Ch. 20 - Estimated income statements, using absorption and...Ch. 20 - Variable and absorption costing Ansara Company had...Ch. 20 - Prob. 20.10EXCh. 20 - Prob. 20.11EXCh. 20 - Product profitability analysis Power Train Sports...Ch. 20 - Territory and product profitability analysis Coast...Ch. 20 - Sales territory and salesperson profitability...Ch. 20 - Segment profitability analysis The marketing...Ch. 20 - Prob. 20.16EXCh. 20 - Contribution margin analysis sales Select Audio...Ch. 20 - Prob. 20.18EXCh. 20 - Contribution margin analysis variable costs Based...Ch. 20 - Variable costing income statement for a service...Ch. 20 - Contribution margin reporting and analysis for a...Ch. 20 - Variable costing income statement and contribution...Ch. 20 - Absorption and variable costing income statements...Ch. 20 - Income statements under absorption costing and...Ch. 20 - Absorption and variable costing income statements...Ch. 20 - Salespersons' report and analysis Walthman...Ch. 20 - Segment variable costing income statement and...Ch. 20 - Contribution margin analysis Farr Industries Inc....Ch. 20 - Prob. 20.1BPRCh. 20 - Income statements under absorption costing and...Ch. 20 - Absorption and variable costing income statements...Ch. 20 - Salespersons' report and analysis Pachec Inc....Ch. 20 - Variable costing income statement and effect on...Ch. 20 - Contribution margin analysis Mathews Company...Ch. 20 - Prob. 1ADMCh. 20 - Prob. 2ADMCh. 20 - Apple Inc.: Segment revenue analysis Segment...Ch. 20 - LVMH: Group segment sales and EBITDA analysis LVMH...Ch. 20 - Prob. 20.1TIFCh. 20 - Communication Bon Jager Inc. manufactures and...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Juroe Company provided the following income statement for last year: Juroes balance sheet as of December 31 last year showed total liabilities of 10,250,000, total equity of 6,150,000, and total assets of 16,400,000. Required: 1. Calculate the return on sales. (Note: Round the percent to two decimal places.) 2. CONCEPTUAL CONNECTION Briefly explain the meaning of the return on sales ratio, and comment on whether Juroes return on sales ratio appears appropriate.arrow_forwardVertical analysis (common-size) percentages for Baker Company’s sales revenue, cost of goods sold, and expenses are as follows. Did Baker’s net income as a percent of sales increase, decrease, or remain unchanged over the 3-year period? Provide numerical support for your answer. Vertical Analysis 2018 2017 2016 Sales revenue 100.0% 100.0% 100.0% Cost of goods sold 60.0 63.9 65.0 Expenses 26.0 26.6 27.5arrow_forwardVertical analysis of income statement Revenue and expense data for Innovation Quarter Inc. for two recent years are as follows: A. Prepare an income statement in comparative form, stating eachitem for both years as a percent of sales. (Round to the nearestwhole percentage.)B. Comment on the significant changes disclosed by thecomparative income statement.arrow_forward

- b. The vertical analysis indicates that the cost of goods sold as a percent of sales by 8 percentage points, while selling expenses - by 4 percentage points, and administrative expenses by 1 percentage points. Thus, net income as a percent of sales by 3 percentage points.arrow_forwardVertical Analysis of Income Statement Revenue and expense data for Innovation Quarter Inc. for two recent years are as follows: Current Year Previous Year Sales Cost of merchandise sold Selling expenses Administrative expenses Income tax expense Sales a. Prepare an income statement in comparative form, stating each item for both years as a percent of sales. If required, round percentages to one decimal place. Enter all amounts as positive numbers. Innovation Quarter Inc. Comparative Income Statement For the Years Ended December 31 Current year Amount Current year Percent $388,000 100 248,320 Cost of merchandise sold Gross profit Selling expenses Administrative expenses Total operating expenses Income from operations Income tax expense $388,000 248,320 54,320 62,080 7,760 Net income $353,000 208,270 56,480 52,950 14,120 $ 54,320 62,080 7,760 % % % % % % % % % Previous year Amount Previous year Percent $353,000 100 ✓ % 208,270 $ 56,480 52,950 14,120 % % % % % % % %arrow_forwardVertical Analysis of Income Statement Revenue and expense data for Innovation Quarter Inc. for two recent years are as follows: Current Year Previous Year Sales $457,000 $407,000 Cost of goods sold 283,340 231,990 Selling expenses 68,550 69,190 Administrative expenses 77,690 65,120 Income tax expense 9,140 16,280 a. Prepare an income statement in comparative form, stating each item for both years as a percent of sales. If required, round percentages to one decimal place. Enter all amounts as positive numbers. Innovation Quarter Inc. Comparative Income Statement For the Years Ended December 31 Current year Amount Current year Percent Previous year Amount Previous year Percent Sales $457,000 % $407,000 % Cost of goods sold 283,340 231,990 % % % Selling expenses 68,550 % 69,190 Administrative expenses 77,690 % 65,120 % % % % % Income tax expense 9,140 % 16,280 % % % b. The vertical analysis indicates that the cost of goods sold as a percent of sales by 5 percentage points, while selling…arrow_forward

- Vertical Analysis of Income Statement Revenue and expense data for Innovation Quarter Inc. for two recent years are as follows: Previous Year Sales Cost of goods sold Selling expenses Administrative expenses Income tax expense Current Year $447,000 272,670 71,520 71,520 13,410 $384,000 215,040 69,120 57,600 15,360arrow_forward1. Prepare a comparative income statement with horizontal analysis for the two-year period, using 20Y2 as the base year. Enter decreases as negative amounts and negative percentages. Round percentage chang to one decimal place. Greyhound Technology Company Comparative Income Statement For the Years Ended December 31, 20Y3 and 20Y2 Increase (Decrease) Increase (Decrease) 20Y3 20Y2 Amount Percent Sales $636,292 5541,000 Cost of goods sold (462,400) (340,000) Gross profit $173,892 $201,000 Seling expenses S(66,700) s(46,000) Administratve expenses (38,400) (29,000) Total operating expenses $(105,100) $(75,000) Income from operations $68,792 $126,000 Other income 2,880 2,300 Income before income tax $71,672 $128,300 Income tax expense (20,100) (38,500) Net income $51,572 S89,800arrow_forwardAssume the following sales data for a company: Current year $861,289 Preceding year 512,943 What is the percentage increase in sales from the preceding year to the current year? a.67.91% b.59.56% c.40.44% d.167.91%arrow_forward

- Horizontal Analysis of Income Statement For 20Y2, McDade Company reported a decline in net income. At the end of the year, T. Burrows, the president, is presented with the following condensed comparative income statement: McDade Company Comparative Income Statement For the Years Ended December 31, 20Y2 and 20Y1 20Υ2 20Υ1 Sales $829,639 $693,000 Cost of merchandise sold 616,000 440,000 Gross profit $213,639 $253,000 Selling expenses $87,000 $58,000 Administrative expenses 50,320 37,000 Total operating expenses $137,320 $95,000 Income from operations $76,319 $158,000 Other revenue 3,634 2,900 Income before income tax expense $79,953 $160,900 Income tax expense 22,400 48,300 Net income $57,553 $112,600 Required:arrow_forwardAssume the following sales data for a company: Line Item Description Amount Current year $891,303 Preceding year 515,759 What is the percentage increase in sales from the preceding year to the current year?arrow_forward1. Prepare a comparative income statement with horizontal analysis for the two-year period, using 20Y2 as the base year. Enter decreeses as negative amounts and negative percentages. Round percentage changes to one decimal place. Greyhound Technology Company Comparative Income Statement For the Years Ended December 31, 20Y3 and 20Y2 Increase (Decrease) Increase (Decrease) Amount 20Υ3 20Y2 Percent Sales $739,806 $646,000 S Cost of goods sold (533,000) (410,000) Gross profit $206,806 $236,000 Seling expenses $(74,250) $(54,000) Administrative expenses (43,180) 4,00) Total operating expenses 117,430) $(88,000) Income from operations $89.376 $148.000 3,351 2,700 Other income Income before income tax $92,727 $150,700 S (26,000) (45,200) Income tax expense $66,727 S105,500 Net incomearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:9781337119207

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

How To Analyze an Income Statement; Author: Daniel Pronk;https://www.youtube.com/watch?v=uVHGgSXtQmE;License: Standard Youtube License