Financial & Managerial Accounting

14th Edition

ISBN: 9781337119207

Author: Carl Warren, James M. Reeve, Jonathan Duchac

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

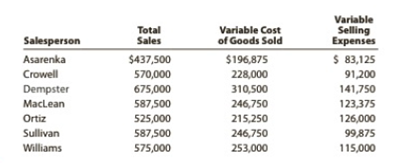

Chapter 20, Problem 20.4BPR

Salespersons' report and analysis

Pachec Inc. employs seven salespersons to sell and distribute its product throughout the slate. Data taken from reports received from the salespersons during the year ended June 30 are as Follows:

Instructions

- 1. Prepare a table indicating contribution margin, variable cost of goods sold as a percent of sales, variable selling expenses as a percent of sales, and contribution margin ratio by salesperson.

- 2. Which salesperson generated the highest contribution margin ratio for the year and why?

- 3. Briefly list factors other than contribution margin that should be considered in evaluating the performance of salespersons.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Salespersons' Report and Analysis

Walthman Industries Inc. employs seven salespersons to sell and distribute its product throughout the state. Data taken from reports received from the salespersons during the year ended December 31 are as follows:

Salesperson Total Sales Variable Cost of Goods Sold

Variable Selling Expenses

$115,940

135,000

279,790

236,340

283,040

282,150

264,150

Case

Dix

Johnson

LaFave

Orcas

Sussman

Willbond

Required:

1. Prepare a table indicating contribution margin, variable cost of goods sold as a percent of sales, variable selling expenses as a percent of sales, and contribution margin ratio by salesperson. Round percents to the nearest whole number.

Enter all amounts as positive numbers.

Salesperson Contribution Margin

Case

Dix

Johnson

LaFave

Orcas

$341,000

375,000

571,000

606,000

488,000

627,000

587,000

Sussman

Willbond

$

$51,150

75,000

108,490

84,840

78,080

112,860

105,660

Waltham Industries Inc.

Salespersons' Analysis

For the Year Ended December 31

Variable…

Salespersons' Report and Analysis

Pachec Inc. employs seven salespersons to sell and distribute its product throughout the state. Data taken from reports received from the

salespersons during the year ended June 30 are as follows:

Variable

Total

Variable Cost

Selling

Salesperson

Sales

of Goods Sold

Expenses

Asarenka

$437,500

$196,875

$83,125

Crowell

570,000

228,000

91,200

Dempster

141,750

675,000

310,500

MacLean

587,500

246,750

123,375

Ortiz

525,000

215,250

126,000

Sullivan

587,500

246,750

99,875

Williams

575,000

253,000

115,000

Required:

1. Prepare a table indicating contribution margin, variable cost of goods sold as a percent of sales, variable selling expenses as a percent of sales,

and contribution margin ratio by salesperson. Round percents to the nearest whole number. Enter all amounts as positive numbers.

Salespersons' Report and Analysis

Walthman Industries Inc. employs seven salespersons to sell and distribute its product throughout the state. Data taken from reports received from the salespersons during the year ended December 31 are as follows:

Salesperson

Total Sales

Variable Cost of Goods Sold

Variable Selling Expenses

Case

$429,000

$184,470

$90,090

Dix

417,000

212,670

58,380

Johnson

465,000

195,300

102,300

LaFave

585,000

204,750

87,750

Orcas

418,000

229,900

66,880

Sussman

407,000

215,710

85,470

Willbond

580,000

191,400

127,600

Required:

1. Prepare a table indicating contribution margin, variable cost of goods sold as a percent of sales, variable selling expenses as a percent of sales, and contribution margin ratio by salesperson. Round percents to the nearest whole number. Enter all amounts as positive numbers.

Waltham Industries Inc.

Salespersons' Analysis

For the Year Ended…

Chapter 20 Solutions

Financial & Managerial Accounting

Ch. 20 - What types of costs are customarily included in...Ch. 20 - Which type of manufacturing cost (direct...Ch. 20 - Which of the following costs would be included in...Ch. 20 - In the variable costing income statement, how are...Ch. 20 - Since all costs of operating a business are...Ch. 20 - Discuss how financial data prepared on the basis...Ch. 20 - Why might management analyze product...Ch. 20 - Explain why rewarding sales personnel on the basis...Ch. 20 - Discuss the two factors affecting both sales and...Ch. 20 - How is the quantity factor for an increase or a...

Ch. 20 - Explain why service companies use different...Ch. 20 - Variable costing Marley Company has the following...Ch. 20 - Variable costingproduction exceeds sales Fixed...Ch. 20 - Variable costing sales exceed production The...Ch. 20 - Analyzing income under absorption and variable...Ch. 20 - Contribution margin by segment The following...Ch. 20 - Contribution margin analysis The actual variable...Ch. 20 - Inventory valuation under absorption costing and...Ch. 20 - Income statements under absorption costing and...Ch. 20 - Income statements under absorption costing and...Ch. 20 - Cost of goods manufactured, using variable costing...Ch. 20 - Variable costing income statement On November 30,...Ch. 20 - Absorption costing income statement On March 31....Ch. 20 - Variable costing income statement The following...Ch. 20 - Estimated income statements, using absorption and...Ch. 20 - Variable and absorption costing Ansara Company had...Ch. 20 - Prob. 20.10EXCh. 20 - Prob. 20.11EXCh. 20 - Product profitability analysis Power Train Sports...Ch. 20 - Territory and product profitability analysis Coast...Ch. 20 - Sales territory and salesperson profitability...Ch. 20 - Segment profitability analysis The marketing...Ch. 20 - Prob. 20.16EXCh. 20 - Contribution margin analysis sales Select Audio...Ch. 20 - Prob. 20.18EXCh. 20 - Contribution margin analysis variable costs Based...Ch. 20 - Variable costing income statement for a service...Ch. 20 - Contribution margin reporting and analysis for a...Ch. 20 - Variable costing income statement and contribution...Ch. 20 - Absorption and variable costing income statements...Ch. 20 - Income statements under absorption costing and...Ch. 20 - Absorption and variable costing income statements...Ch. 20 - Salespersons' report and analysis Walthman...Ch. 20 - Segment variable costing income statement and...Ch. 20 - Contribution margin analysis Farr Industries Inc....Ch. 20 - Prob. 20.1BPRCh. 20 - Income statements under absorption costing and...Ch. 20 - Absorption and variable costing income statements...Ch. 20 - Salespersons' report and analysis Pachec Inc....Ch. 20 - Variable costing income statement and effect on...Ch. 20 - Contribution margin analysis Mathews Company...Ch. 20 - Prob. 1ADMCh. 20 - Prob. 2ADMCh. 20 - Apple Inc.: Segment revenue analysis Segment...Ch. 20 - LVMH: Group segment sales and EBITDA analysis LVMH...Ch. 20 - Prob. 20.1TIFCh. 20 - Communication Bon Jager Inc. manufactures and...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Salespersons report and analysis Walthman Industries Inc. employs seven salespersons to sell and distribute its product throughout the state. Data taken from reports received from the salespersons during the year ended December 31 are as follows: Instructions 1. Prepare a table indicating contribution margin, variable cost of goods sold as a percent of sales, variable selling expenses as a percent of sales, and contribution margin ratio by salesperson. (Round whole percent to one digit after decimal point.) 2. Which salesperson generated the highest contribution margin ratio for the year and why? 3. Briefly list factors other than contribution margin that should be considered in evaluating the performance of salespersons.arrow_forwardUse the following information for Exercises 2-47 through 2-49. Jasper Company provided the following information for last year: Last year, beginning and ending inventories of work in process and finished goods equaled zero. Exercise 2-49 Income Statement Refer to the information for Jasper Company on the previous page. Required: 1. Prepare an income statement for Jasper for last year. Calculate the percentage of sales for each line item on the income statement. (Note: Round percentages to the nearest tenth of a percent.) 2. CONCEPTUAL CONNECTION Briefly explain how a manager could use the income statement created for Requirement 1 to better control costs.arrow_forwardCustomers as a Cost Object Morrisom National Bank has requested an analysis of checking account profitability by customer type. Customers are categorized according to the size of their account: low balances, medium balances, and high balances. The activities associated with the three different customer categories and their associated annual costs are as follows: Additional data concerning the usage of the activities by the various customers are also provided: Required: (Note: Round answers to two decimal places.) 1. Calculate a cost per account per year by dividing the total cost of processing and maintaining checking accounts by the total number of accounts. What is the average fee per month that the bank should charge to cover the costs incurred because of checking accounts? 2. Calculate a cost per account by customer category by using activity rates. 3. Currently, the bank offers free checking to all of its customers. The interest revenues average 90 per account; however, the interest revenues earned per account by category are 80, 100, and 165 for the low-, medium-, and high-balance accounts, respectively. Calculate the average profit per account (average revenue minus average cost from Requirement 1). Then calculate the profit per account by using the revenue per customer type and the unit cost per customer type calculated in Requirement 2. 4. CONCEPTUAL CONNECTION After the analysis in Requirement 3, a vice president recommended eliminating the free checking feature for low-balance customers. The bank president expressed reluctance to do so, arguing that the low-balance customers more than made up for the loss through cross-sales. He presented a survey that showed that 50% of the customers would switch banks if a checking fee were imposed. Explain how you could verify the presidents argument by using ABC.arrow_forward

- Using the information in the previous exercises about Marleys Manufacturing, determine the operating income for department B, assuming department A sold department B 1,000 units during the month and department A reduces the selling price to the market price.arrow_forwardWest Island distributes a single product. The companys sales and expenses for the month of June are shown. Using the information presented, answer these questions: A. What is the break-even point in units sold and dollar sales? B. What is the total contribution margin at the break-even point? C. If West Island wants to earn a profit of $21,000, how many units would they have to sell? D. Prepare a contribution margin income statement that reflects sales necessary to achieve the target profit.arrow_forwardSalespersons' Report and Analysis Walthman Industries Inc. employs seven salespersons to sell and distribute its product throughout the state. Data taken from reports received from the salespersons during the year ended December 31 are as follows: Salesperson Total Sales Variable Cost of Goods Sold Variable Selling Expenses Case $432,000 $211,680 $86,400 Dix 347,000 166,560 72,870 Johnson 564,000 293,280 101,520 LaFave 611,000 293,280 85,540 Orcas 588,000 199,920 76,440 Sussman 437,000 214,130 74,290 Willbond 525,000 252,000 73,500 Required: 1. Prepare a table indicating contribution margin, variable cost of goods sold as a percent of sales, variable selling expenses as a percent of sales, and contribution margin ratio by salesperson. Round percents to the nearest whole number. Enter all amounts as positive numbers. Waltham Industries Inc. Salespersons' Analysis For the Year Ended…arrow_forward

- Salespersons' Report and Analysis Walthman Industries Inc. employs seven salespersons to sell and distribute its product throughout the state. Data taken from reports received from the salespersons during the year ended December 31 are as follows: Salesperson Total Sales Variable Cost of Goods Sold Variable Selling Expenses Case $581,000 $284,690 $122,010 Dix 576,000 247,680 92,160 Johnson 587,000 246,540 129,140 LaFave 461,000 207,450 96,810 Orcas 525,000 194,250 84,000 Sussman 492,000 241,080 78,720 Willbond 426,000 187,440 55,380 Required: 1. Prepare a table indicating contribution margin, variable cost of goods sold as a percent of sales, variable selling expenses as a percent of sales, and contribution margin ratio by salesperson. Round percents to the nearest whole number. Enter all amounts as positive numbers. Waltham Industries Inc. Salespersons' Analysis For the Year Ended December 31 Variable Cost of Goods Variable Selling Expenses Contribution Margin Salesperson Contribution…arrow_forwardWaltham Industries Inc. employs seven salespersons to sell and distribute its product throughout the state. Data taken from reports received from the salespersons during the year ended December 31 are as follows: Variable Cost Variable Selling Salesperson Total Sales of Goods Sold Expenses Case $610,000 $268,400 $109,800 Dix 603,000 241,200 96,480 Johnson 588,000 305,760 105,840 LaFave 586,000 281,280 123,060 Orcas 616,000 221,760 86,240 Sussman 620,000 310,000 Willbond 592,000 272,320 124,000 88,800 Required: 1. Prepare a table indicating contribution margin, variable cost of goods sold as a percent of sales, variable selling expenses as a percent of sales, and contribution margin ratio by salesperson, Round percents to the nearest whole number. Enter all amounts as positive numbers. Waltham Industries Inc. Salespersons' Analysis For the Year Ended December 31 Salesperson Contribution Margin Variable Cost of Goods Sold Variable Selling Expenses Contribution Margin as a Percent of…arrow_forwardSalespersons' Report and Analysis Walthman Industries Inc. employs seven salespersons to sell and distribute its product throughout the state. Data taken from reports received from the salespersons during the year ended December 31 are as follows: Salesperson Total Sales Variable Cost of Goods Sold Variable Selling Expenses Case $514,000 $246,720 $92,520 Dix 380,000 148,200 68,400 Johnson 455,000 209,300 86,450 LaFave 531,000 297,360 106,200 226,800 88,200 Orcas 630,000 219,520 89,600 Sussman 448,000 355,000 198,800 006 Willbond Required:arrow_forward

- Salespersons' Report and Analysis Walthman Industries Inc. employs seven salespersons to sell and distribute its product throughout the state. Data taken from reports received from the salespersons during the year ended December 31 are as follows: Salesperson Total Sales Variable Cost of Goods Sold Variable Selling Expenses Case $372,000 $197,160 $70,680 Dix 566,000 277,340 113,200 Johnson 594,000 308,880 118,800 LaFave 344,000 172,000 51,600 Orcas 346,000 110,720 58,820 Sussman 559,000 318,630 72,670 Willbond 395,000 134,300 75,050 Required: 1. Prepare a table indicating contribution margin, variable cost of goods sold as a percent of sales, variable selling expenses as a percent of sales, and contribution margin ratio by salesperson. Round percents to the nearest whole number. Enter all amounts as positive numbers. Waltham Industries Inc.Salespersons' AnalysisFor the Year Ended December 31…arrow_forwardAnalyzing profitability analysis, service company Burlington Internet Services is an Internet service provider for commercial and residential Customers. The company provided the following data for its two types of customers for the month of August: For each type of customer, determine both the contribution margin per customer and the contribution margin ratio. Round to twos decimal places. Which type of service and more profitable?arrow_forwardSalespersons' Report and Analysis Walthman Industries Inc. employs seven salespersons to sell and distribute its product throughout the state. Data taken from reports received from the salespersons during the year ended December 31 are as follows: Salesperson Total Sales Variable Cost of Goods Sold Variable Selling Expenses Case $424,000 $233,200 $80,560 Dix 371,000 178,080 63,070 Johnson 469,000 262,640 75,040 LaFave 586,000 334,020 111,340 Orcas 538,000 199,060 91,460 Sussman 529,000 185,150 116,380 Willbond 569,000 216,220 91,040 Required: 1. Prepare a table indicating contribution margin, variable cost of goods sold as a percent of sales, variable selling expenses as a percent of sales, and contribution margin ratio by salesperson. Round percents to the nearest whole number. Enter all amounts as positive numbers. Waltham Industries Inc.Salespersons' AnalysisFor the Year Ended December 31…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY